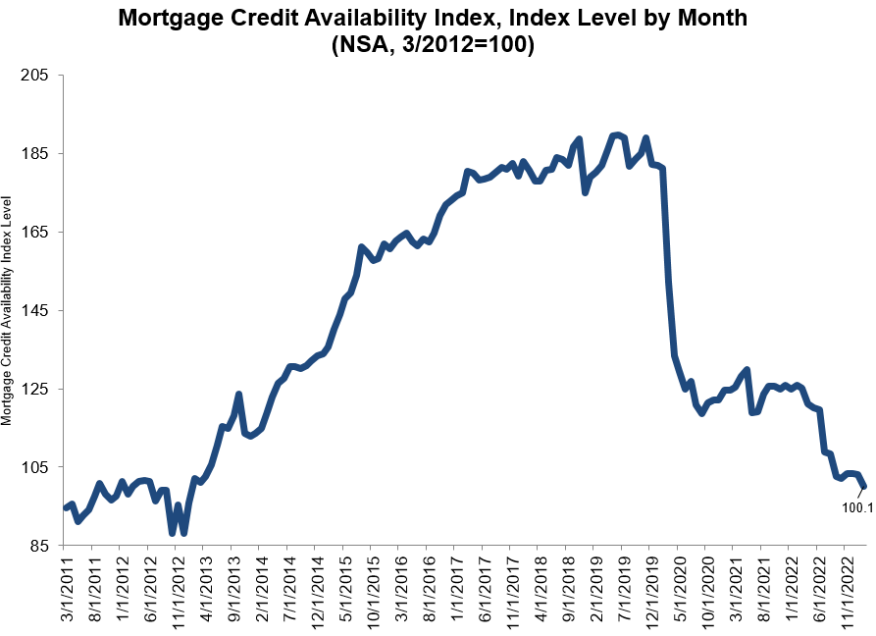

MBA: Credit Availability Slumps In February

This month's credit availability decreased to its lowest level since January 2013.

- The Conventional MCAI decreased by 4.4%, while the Government MCAI decreased by 1.6%.

- The Jumbo MCAI decreased by 4.4%, and the Conforming MCAI fell by 4.3%.

Mortgage credit availability dipped in February according to the Mortgage Credit Availability Index (MCAI) released Tuesday by the Mortgage Bankers Association (MBA).

The MCAI fell by 3% to 100.1 in February, indicating that lending standards are tightening according to the MBA.

The report also saw the Conventional MCAI decrease by 4.4%, while the Government MCAI decreased by 1.6%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 4.4%, and the Conforming MCAI fell by 4.3%.

According to the MBA’s Vice President and Deputy Chief Economist, Joel Kan, February’s mortgage credit availability decreased to its lowest level since January 2013. Kan also said that all loan types saw declines in availability over the month

“The conforming subindex decreased 4.3% to its lowest level in the survey, which goes back to 2011. This decline was driven by the ongoing trend of shrinking industry capacity as mortgage rates stayed significantly higher than a year ago,” Kan continued. “Additionally, in this volatile rate environment and potentially weakening economy, there was also a reduction in refinance programs offered for low credit score and high-LTV borrowers.”

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure that indicates the availability of mortgage credit at a point in time. To learn more about the ICE Mortgage Technology platform click here.