MBA: Mortgage Credit Availability Fell For 8th Straight Month

Higher rates and the worsening outlook for the housing market and economy cited for decline.

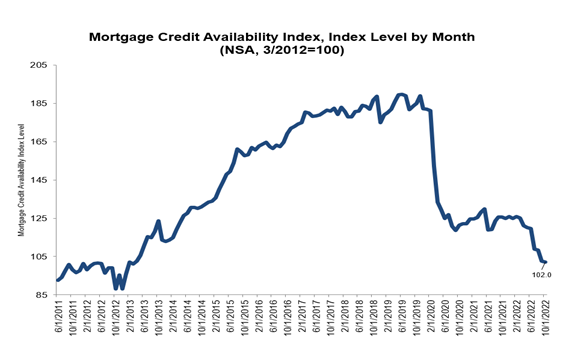

The availability of mortgage credit hasn’t been this low since Barack Obama was president.

According to the Mortgage Bankers Association (MBA), its Mortgage Credit Availability Index (MCAI) fell by 0.5% to 102 in October, its lowest level since March 2013. It’s the eighth straight monthly decline.

The MCAI report, which analyzes data from ICE Mortgage Technology, was benchmarked at 100 in March 2021. A decline in the MCAI indicates that lending standards are tightening, while increases in the index indicate loosening credit.

The Conventional MCAI decreased 1.5%, while the Government MCAI increased by 0.4%, the MBA said.

Of the indices that make up the Conventional MCAI, the Jumbo MCAI decreased by 2.5%, while the Conforming MCAI remained unchanged.

“Much higher mortgage rates and the worsening outlook for the housing market and economy are behind the continued tightening in credit availability,” said Joel Kan, MBA’s vice president and deputy chief economist. “Lenders continue to reduce their capacity and are eliminating some loan offerings, including certain types of refinance loan products and others that require less-than-full borrower documentation.”

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index, the MBA said.

The primary difference between the total MCAI and the component indices are the population of loan programs they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs.

The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same base levels as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted base levels in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure that indicates the availability of mortgage credit at a point in time.