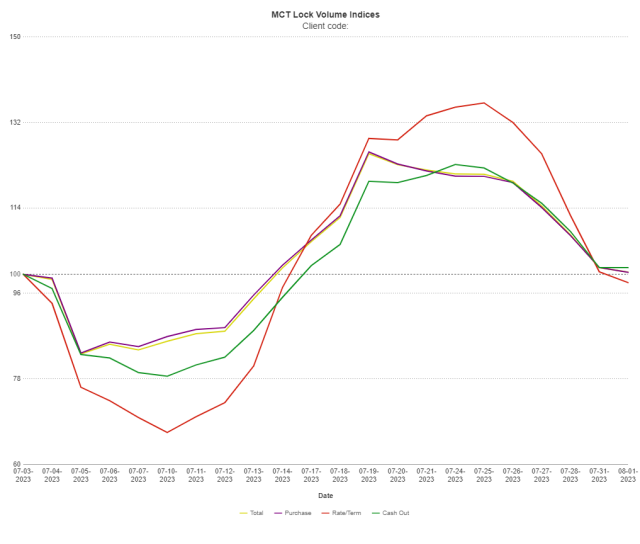

Slight .44% increase in mortgage lock volume; industry faces uncertain future.

Mortgage Capital Trading Inc., a San Diego-based mortgage hedge advisory and secondary marketing software firm, saw a marginal 0.44% increase in mortgage lock volume between June and July. This essentially flat change is believed to be due to seasonal momentum throughout the summer.

"While July’s mortgage lock volume remained relatively flat, mortgage rates continued to climb through July," said MCT’s Chief Operations Office Phil Rasori. He further warned that if rates hold or continue to rise from the levels established in the first week of August, a drop in volume can be expected.

Factors such as the Federal Reserve's July decision to hike the Federal Funds Rate, contributing to an eight-month high in mortgage rates, and Fitch's recent move to downgrade the U.S. credit rating may present challenges for the mortgage industry. The combination of these factors and the highest 10-year treasury yield in years signals potential instability ahead.

Moreover, the MCT Indices for this month revealed a significant 13% decrease in total lock volume compared to the same period last year. This downturn, however, could be mitigated by recent economic indicators.

Rasori pointed to recent job numbers as a possible glimmer of hope, stating, "[If] indications of a slightly cooling labor market were to persist into the future, this would provide more cover for the Fed to continue to pause and eventually cut rates."

The MCT's Lock Volume Indices provide a detailed view of rate lock volume in the residential mortgage industry, examining different lock types such as purchase, rate/term refinance, and cash-out refinance. It spans various lenders, including variations in size, products/services offered, and business models across MCT's national footprint.