Mortgage Application Payments Rose 3.7% In October

Mortgage payments are up by $629 in the first 10 months of the year, a 45.5% increase.

The cost of mortgages continued to rise in October, thanks to higher mortgage rates and home prices still high despite declines.

The Mortgage Bankers Association (MBA) on Tuesday released its monthly Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time — relative to income — using data from MBA’s Weekly Applications Survey (WAS).

According to the MBA, the national median payment applied for by applicants increased to $2,012, up 3.7% from $1,941 in September.

“Prospective homebuyers continued to feel the effects of higher mortgage rates in October, with the 70-basis-point jump in rates leading to the typical monthly mortgage payment rising to a new survey high of $2,012,” said Edward Seiler, MBA’s associate vice president, housing economics, and executive director, Research Institute for Housing America. “Higher mortgage rates are also squeezing the purchasing power of prospective buyers.”

The median loan amount in October decreased to $295,000, the lowest level since January 2021, Seiler said. “Weakening affordability and increased economic uncertainty are expected to slow homebuying activity in the final two months of the year,” he said.

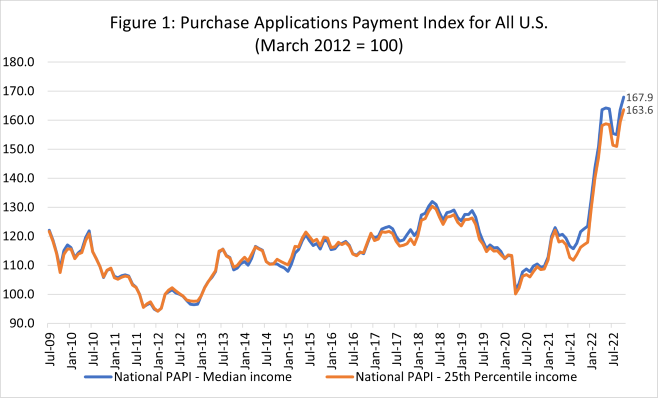

An increase in the PAPI — which indicates declining borrower affordability conditions — means the mortgage payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings, MBA said. A decrease in the PAPI — indicating improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI increased to 167.9 in October, up 2.7% from 163.6 in September. The index eclipsed the previous high of 164.2 in May 2022.

The index has jumped 36% in the first 10 months of 2022 and is up 38.1% compared to October 2021 (121.6). For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,323 in October from $1,271 in September. Mortgage payments are up by $629 in the first 10 months of the year, a 45.5% increase.

MBA’s national mortgage payment to rent ratio (MPRR) increased to 1.46 at the end of the third quarter from 1.44 at the end of the second quarter, meaning mortgage payments for home purchases have increased relative to rents.

The national median asking rent in the third quarter increased by 1.5% on a quarterly basis to $1,334 ($1,314 in the second quarter). The 25th percentile mortgage application payment to median asking rent ratio was 0.95 in September, up just a tick from 0.94 in June.

“Median asking rents increased at an annualized 6.2% between the second and third quarters of 2022 but have shown some deceleration in recent months,” Seiler said. “Despite the increasing mortgage rates in the third quarter, elevated rental payments kept the MPRR under one for many potential first-time homebuyer who may be looking for a smaller mortgage amount.”

PAPI Highlights:

- The national median mortgage payment for FHA loan applicants was $1,666 in October, up from $1,566 in September and $1,056 in October 2021.

- The national median mortgage payment for conventional loan applicants was $2,047, up from $2,003 in September and $1,431 in October 2021.

- The top five states with the highest PAPI were: Nevada (279.7), Idaho (269.7), Arizona (241.7), Washington (219.7), and Utah (218.9).

- The top five states with the lowest PAPI were: Alaska (113.6), Washington, D.C. (114.2), West Virginia (115.1), Connecticut (120.9), and Louisiana (125.6).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 164.0 in September to 168.4 in October.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 149.9 in September to 153.9 in October.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 163.9 in September to 168.3 in October.