Mortgage Application Payments Rose 4.9% In February

MBA said it expects mortgage rates to decline later this year.

- The national median payment applied for by home purchase applicants increased in February to $2,061.

- For borrowers applying for lower-payment mortgages, the national mortgage payment increased 5.2% to $1,391 in February.

The cost of buying a home increased nearly 5% in February, but the growing likelihood of a recession has raised expectations that mortgage rates will fall later this year.

That’s according to the Mortgage Bankers Association (MBA), which on Thursday released its monthly Purchase Applications Payment Index (PAPI), a measure of how new monthly mortgage payments vary across time, relative to income, using data from the MBA’s Weekly Applications Survey (WAS).

According to the index, the national median payment applied for by home purchase applicants increased in February to $2,061, up 4.9% from $1,964 in January.

“Higher mortgage rates and home prices led to continued erosion in homebuyer affordability in February,” said Edward Seiler, MBA's associate vice president, housing economics, and executive director of the Research Institute for Housing America. "Many prospective homebuyers continue to feel this affordability squeeze, with the typical purchase application loan amount increasing $8,003 over the month to $320,003. Given ongoing economic uncertainty and the likelihood of a recession, MBA expects mortgage rates to decline as this year progresses, which will help affordability.”

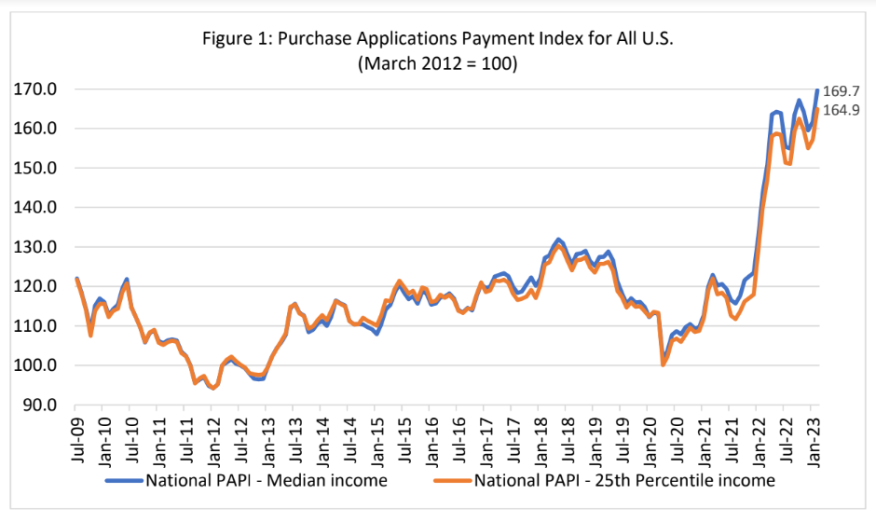

An increase in MBA’s PAPI — which indicates declining borrower affordability conditions — means that the mortgage payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or declining earnings. A decrease in the PAPI — which indicates improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI increased 4.9% to 169.7 in February from 161.7 in January, the MBA said, adding the index is at a record high from its previous series high of 167.2 in October 2022. The index is up 18.1% from the same point last year.

For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased 5.2% to $1,391 in February from $1,322 in January.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased to $2,492 in February, up 4.8% from $2,379 in January.

Other Key Findings

- The national median mortgage payment was $2,061 in February, up from $1,964 in January and $1,920 in December. It is up $408, or 24.7%, from one year ago.

- The national median mortgage payment for FHA loan applicants was $1,707 in February, up 5.4% from $1,619 in January and up 42% from $1,201 in February 2022.

- The national median mortgage payment for conventional loan applicants was $2,117, up 5.4% from $2,009 in January and up 21% from $1,750 in February 2022.

- The top five states with the highest PAPI were: Nevada (251.6), Idaho (249.3), Arizona (225.7), Utah (222.8), and California (217.4).

- The top five states with the lowest PAPI were: Connecticut (111.7), North Dakota (118.2), West Virginia (119.8), Louisiana (121.1), and Vermont (121.6).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing 4.95% from 161.7 in January to 169.7 in February.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing 4.9% from 154.6 in January to 162.2 in February.

- Homebuyer affordability decreased for White households, with the national PAPI increasing 4.9% from 162.9 in January to 170.9 in February.

The MBA’s Purchase Applications Payment Index (PAPI) measures how new mortgage payments vary across time relative to income. Higher index values indicate that the mortgage payment to income ratio (PIR) is higher than in a month where the index is lower. PAPI directly uses MBA’s Weekly Applications Survey (WAS) data to calculate mortgage payments.