Mortgage Applications For New Home Sales Dip; FHA Share Hits Decade High

Despite a 12% monthly drop, year-on-year figures show a 14.9% increase; First-time homebuyers drive surge in FHA applications.

Mortgage applications for new home sales in September 2023 saw a decline of 12% from August 2023, despite a year-over-year increase of 14.9%, according to the latest data from the Mortgage Bankers Association (MBA) Builder Application Survey (BAS). This dip is attributed to the recent surge in mortgage rates, which has deterred potential homebuyers.

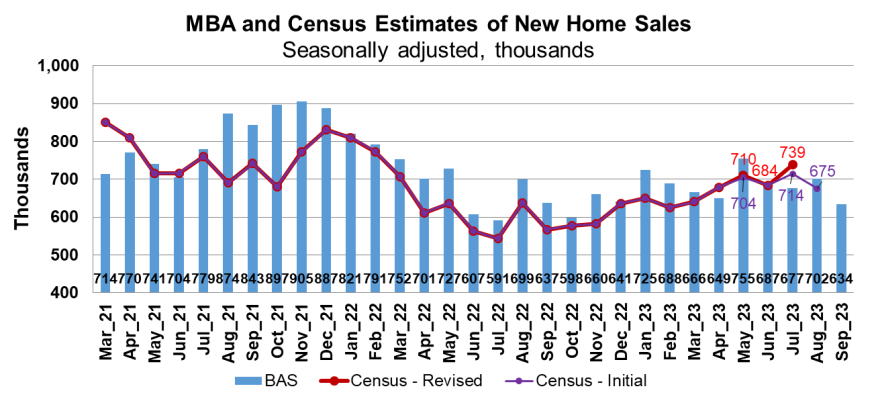

“Applications for new home purchases decreased over the month but were 15% higher than a year ago, which is the eighth consecutive month of annual gains," said MBA's Deputy Chief Economist Joel Kan. "Demand for newly constructed homes remains relatively strong due to the persistent shortage of resale inventory, but increasing mortgage rates are impacting would-be buyers. MBA’s estimate of new home sales dropped to a 634,000-unit pace, the weakest sales pace since October 2022.”

Another significant observation from the BAS data is the rise in the FHA share of applications, which reached 25% in September. This is the highest since the inception of the survey in 2013, indicating sustained demand from first-time homebuyers.

The MBA's estimate, which has historically been a precursor to the U.S. Census Bureau’s New Residential Sales report, suggests that new single-family home sales were at a seasonally adjusted annual rate of 634,000 units for September 2023. This estimate, derived from the BAS data and other factors, represents a decrease of 9.7% from the August pace of 702,000 units. In absolute numbers, there were approximately 51,000 new home sales in September 2023, down 13.6% from the 59,000 sales in August.

A breakdown of the product type revealed that conventional loans comprised 65.1% of loan applications, followed by FHA loans at 25.1%, VA loans at 9.5%, and RHS/USDA loans at a mere 0.3%. The average loan size for new homes also decreased, from $398,092 in August to $397,550 in September.