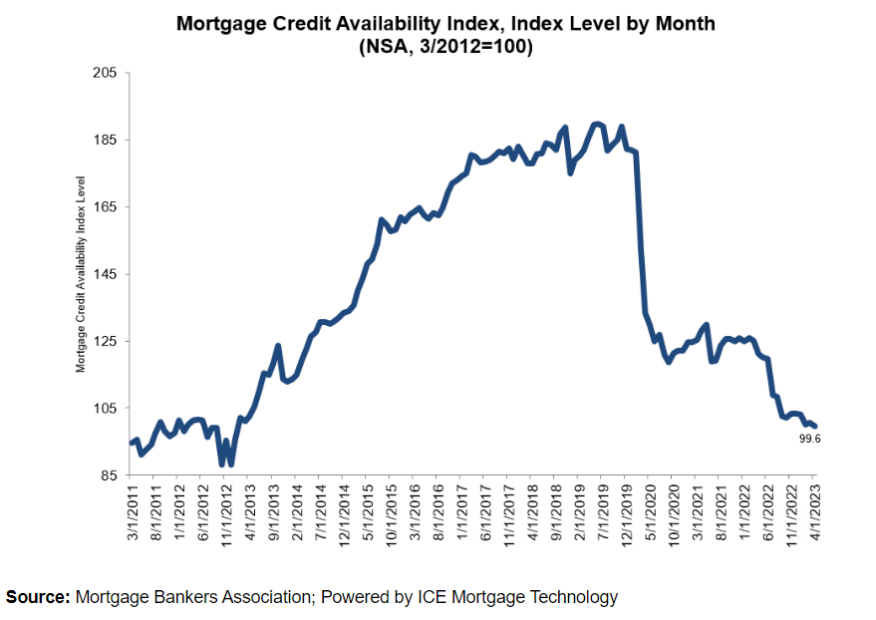

Mortgage Credit Availability At Lowest Level In 10 Years

Decline reflects the tightening in broader credit conditions, MBA said.

- MBA’s Mortgage Credit Availability Index (MCAI) fell by 0.9% to 99.6 in April, lowest since January 2013.

Mortgage credit availability decreased in April to the lowest level in 10 years, the Mortgage Bankers Association (MBA) said Tuesday.

The MBA’s Mortgage Credit Availability Index (MCAI) fell by 0.9% to 99.6 in April, the MBA said. A decline in the MCAI indicates that lending standards are tightening, while increases indicate loosening credit. The index was benchmarked to 100 in March 2012.

The Conventional MCAI increased 0.5%, while the Government MCAI decreased by 2.1%, the MBA said.

Of the component indices of the Conventional MCAI, the Jumbo MCAI increased 1.5%, while the Conforming MCAI fell by 1.1%.

“Mortgage credit availability declined in April to the lowest level since January 2013, reflecting the tightening in broader credit conditions stemming from recent banking sector challenges and an uncertain economic outlook,” said Joel Kan, MBA’s vice president and deputy chief economist. “The contraction was driven by reduced demand for loan programs — such as certain adjustable-rate mortgages loans, cash-out and streamline refinances, and those with lower credit score requirements.”

Kan said the supply of government credit decreased for the third straight month, “as industry capacity continues to adjust to significantly reduced origination volume, along with the expectations of a weakening economy later this year.”

He added, “Even with high mortgage rates and reduced credit availability, the lack of for-sale inventory continues to be the biggest hurdle to more home purchase growth this year.”

The MBA’s MCAI analyzes data from ICE Mortgage Technology. The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI, and are designed to show relative credit risk/availability for each respective index.

The primary difference between the total MCAI and the component indices are the population of the loan programs they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings.

The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.