Mortgage Delinquencies Closed 2022 9% Below 2021: Black Knight

First Look report

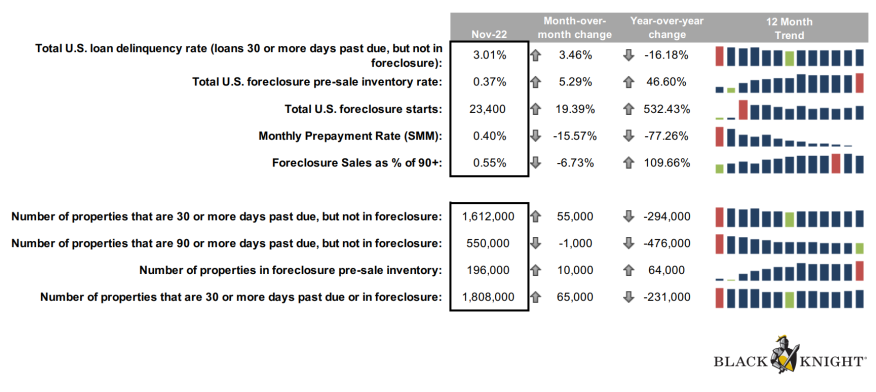

- Mortgage delinquencies ticked up 7 basis points to 3.08%, but still finished the year 30 bps, or 9%, below its level in 2021.

- The number of homeowners with mortgages who were a single payment past due rose by 40,000, or 4.8%, in December.

- Foreclosure starts rose in December for the third consecutive month as well, jumping 15% from November.

While mortgage delinquencies crept up at the end of last year, 2022 still finished as a significantly slower year than the year before, data company Black Knight said.

According to Black Knight’s First Look at December 2022 mortgage performance statistics derived from its database representing a majority of the national mortgage market, mortgage delinquencies ticked up 7 basis points (bps) to 3.08% but still finished the year 30 bps, or 9%, below its level a year earlier.

The report also found that the new, higher mortgage-rate environment’s continues to have an effect on mortgage prepayments, which historically are driven largely by refinances and home sales, both of which fell dramatically in 2022 from a year earlier.

December saw the lowest level of prepayment activity since 2000, when Black Knight first began tracking the metric. In fact, the month marked the third consecutive record low for monthly prepayments, the company said.

In addition, the number of homeowners with mortgages who were a single payment past due rose by 40,000, or 4.8%, in December, while 60-day delinquencies remained flat.

On the other hand, serious delinquencies — loans 90 or more days past due — continued to improve nationwide, falling by 5,000 despite an increase of 8,700 such loans in Florida in the wake of Hurricane Ian, Black Knight said. The vast majority (44) of other states saw seriously past-due loan volumes decline in December.

Foreclosure starts rose in December for the third consecutive month as well. A 15% jump from November put the number of starts at 26,900 for the month, though that also is still about 30% below pre-pandemic levels.

The foreclosure process was started on 4.9% of seriously delinquent loans, up from November, but also still well below (46%) below the rate in December 2019, before the pandemic.

The number of loans in active foreclosure increased by 2.3% to close the year, though that volume remained subdued throughout 2022 after setting record lows in 2021 due to widespread use of moratoriums and forbearance protections, the First Look report said.

The Top 5 states by the percentage of non-current loans (which combines foreclosures and delinquencies as a percentage of active loans) in December 2022 were Mississippi at 6.87% of loans, down 0.54% from a year earlier; Louisiana at 6.33% (down 10.35%); Oklahoma at 5.16% (up 1.56%); West Virginia at 4.92% (down 8.39%); and Alabama at 4.91% (down 3.84%).