Mortgage Economic Review For October 2023

A summary and review of key economic data that affects the mortgage and real estate business.

The Mortgage Economic Review is a monthly summary of Key Economic Indicators, Data, and Events pertinent to Mortgage, Housing, and Finance Professionals.

At a Glance - Key Economic Events and Data released during September 2023

• Interest Rates: The 10-Year Treasury yield rose to 4.58% (Sep 29) from 4.09% (Aug 31).

• Housing: Existing Home Sales fell 0.7% (-15.3% YoY), New Home Sales fell 8.7% (+5.8% YoY), and Pending Home Sales fell 7.1% (-18.7% YoY). Home Prices are up 0.1 % to 4.6% YoY.

• Labor: The US Economy created 187,000 New Jobs during August. The Unemployment Rate rose to 3.8%, Wages increased by 4.3% YoY.

• Inflation: CPI rose 0.6% (+3.7% YoY), and PCE rose 0.4 (+3.5% YoY).

• The Economy: US GDP grew by a 2.1% annualized rate in 2Q2023, up 2.6% YoY.

• Consumers: Retail Sales rose 0.6% (+2.5% YoY), Consumer Confidence and Sentiment fell.

• Stock Markets fell in September: Dow -3.4%, S&P -4.9%, Nasdaq -6.7%.

• Oil Prices rose 8.6% to $91/Barrel (Sep 29) from $84/Barrel (Aug 31).

Interest Rates and Fed Watch

As expected, the Fed wrapped up the September FOMC Meeting and did not raise Interest Rates. The target for Fed Funds remains at 5.25% - 5.50%. Fed Chairman Jerome Powell reiterated the Fed will not reduce Interest Rates until Inflation comes down. Inflation has been stubborn and is expected to decline slowly. Therefore, expect Interest Rates to also decline slowly. When will Interest Rates peak? No one knows for sure. The Fed has left the door open for another Rate hike this year. The Fed expects Core PCE to be 2.6% at the end of 2024. With those projections, many Economists expect Interest Rates to stay at these levels at least through the 1st quarter of 2024, probably the 2nd quarter, unless there is an unexpected shock to the market. The next FOMC Meeting is October 31st and November 1st.

• 10-Year Treasury Note Yield rose to 4.58% (Sep 29) from 4.09% (Aug 31).

• 30-Year Treasury Bond Yield rose to 4.70% (Sep 29) from 4.20% (Aug 31).

• 30-Year Fixed Mortgage rose to 7.31% (Sep 29) from 7.18% (Aug 31).

• 15-Year Fixed Mortgage rose to 6.72% (Sep 29) from 6.55% (Aug 31).

Housing Market Data Released during September 2023

New Home Sales, a bright spot in the Housing Market, dimmed a little as it dropped 8.7%. However, it's still up 5.8% for the year. The triple whammy of high Mortgage Rates, High Home Prices, and lack of Inventory have caused potential Home Buyers to stay on the sidelines. Home Buyers have a sense that things will get better if they wait. Expect these buyers to quickly re-enter the market when issues abate.

• Existing Home Sales (closed deals in August) fell 0.7% to an annual rate of 4,040,000 homes, down 15.3% in the last 12 months. The median Single-Family Home price is $413,500, up 3.7% YoY. The Median Condo price is $354,600, up 6.2% YoY. Homes were on the market for an average of 20 days, and 72% sold in less than a month. Currently, 1,100,000 homes are for sale, down 14.1% YoY.

• New Home Sales (signed contracts in August) fell 8.7% to a seasonally adjusted annual rate of 675,000 homes, up 5.8% YoY. The median New Home price is $430,300 (down from a peak of $496,800 in Oct 2022). The average price is $514,700 (down from a peak of $568,700 in Dec 2022). There are 436,000 New Homes for sale, a 7.8-month supply.

• Pending Home Sales Index (signed contracts in August) fell 7.1% to 71.8 from 77.6 the previous month, down 18.7% YoY.

• Building Permits (issued in August) rose 6.9% to a seasonally adjusted annual rate of 1,543,000 units - down 2.7% YoY. Single-Family Permits rose 2.0% to an annual pace of 949,000 homes, up 7.2% YoY.

• Housing Starts (excavation began in August) fell 11.3% to an annual adjusted rate of 1,283,000, down 14.8% YoY. Single-Family Starts fell 4.3% to 941,000 units, up 2.4% YoY.

• Housing Completions (completed in August) rose 5.3% to an annual adjusted rate of 1,406,000 units - up 3.8% YoY. Single-Family Completions fell 6.6% to an annual adjusted rate of 961,000 homes - down 5.8% YoY.

• S&P/Case-Shiller 20 City Home Price Index rose 0.6% in July, up 0.1% YoY.

• FHFA Home Price Index rose 0.8% in July, up 4.6% YoY.

Labor Market Economic Data Released during September 2023

The Economy created 187,000 New Jobs during August. With 8,827,000 Jobs open, the Labor Market remains tight enough for workers to start striking. UPS paid up to avoided an impending strike with its drivers. The Auto companies were not so lucky. The United Auto Workers initiated a strike against the major Car Makers in September. That strike is currently ongoing and expanding. The UAW is asking for a 40% wage increase and 32 hour work week. This is a prime example of how the Wage-Price Spiral gets started and why stopping it is so difficult.

• The Economy created 187,000 New Jobs during August.

• The Unemployment Rate rose to 3.8% in August.

• The Labor Force Participation Rate rose to 62.8 in August.

• The Average Hourly Wage rose 0.2% during August, up 4.3% YoY.

• Job Openings fell to 8,827,000 in July from 9,165,000 in June.

Inflation Economic Data Released during September 2023

The fight against Inflation had a hiccup as the CPI and PCE ticked up. Why? Higher Oil Prices. Most of the increase in the CPI and PCE was Gasoline Prices. The good news is that Core CPI and Core PCE (which excludes energy costs) are low. The Core PCE number is especially encouraging since 3.9% is the lowest since November 2020. Inflation may be stubborn, but it is headed in the right direction - down.

• CPI rose 0.6%, up 3.7% YoY | Core CPI rose 0.3%, up 4.3% YoY

• PPI rose 0.7%, up 1.6% YoY | Core PPI rose 0.2%, up 2.2% YoY

• PCE rose 0.4%, up 3.5% YoY | Core PCE rose 0.1%, up 3.9% YoY

GDP Economic Data Released during September 2023

The 3rd and Final Estimate for 2nd Quarter 2023 GDP showed the US Economy grew at a 2.1% annualized rate, up 2.6% YoY. The Recession debate is ongoing. Treasury Secretary Yellen said she is feeling good about the Economy, while other Economists are predicting a "Mild Recession" in the first half of 2024. Meanwhile, some Economists think the Fed can tame Inflation without a Recession. If there is a Recession, they expect it to be mild.

Consumer Economic Data Released during September 2023

So far this year, the Consumer has maintained their spending habits. Retail Sales is up 2.5% for the year. As long as Consumers are confident in their Jobs, they will continue to spend, even though they don't feel that confident in the general Economy. However, Consumer Spending is now more focused on necessities. Discretionary items have taken a hit. Surveys have shown that many Consumers are waiting for Holiday Sales, like Black Friday, to buy discretionary items. That means retailers could have a very Happy Holiday season, which is just around the corner.

• Retail Sales rose 0.6% during August, up 2.5% in the last 12 months.

• Consumer Confidence Index fell 5.2% to 103.0 from 108.7 the prior month, down 4.5% YoY.

• Consumer Sentiment Index (U of M) fell 2.0% to 68.1 from 69.5 the previous month.

Energy, International, and Things You May Have Missed

• West Texas Intermediate Crude rose to $91/Barrel (Sep 29) from $84/Barrel (Aug 31).

• North Sea Brent Crude rose to $95/Barrel (Sep 29) from $87/Barrel (Aug 31).

• Natural Gas rose to $2.94/MMBtu (Sep 29) from $2.75/MMBtu (Aug 31).

• A US Government shutdown was averted after Congress passed a Stopgap Funding Bill to keep the US Government open until November 17th.

• The European Central Bank raised Interest Rates for the 10th time this cycle. Like the Fed, the ECB won’t say when they will stop raising rates.

The Mortgage Economic Review is a concise summary of Key Economic Data that influences the Mortgage and Housing Markets. It's a quick read that keeps busy Professionals updated on important Economic Information. Feel free to share this with colleagues in the Mortgage, Housing, Finance, and Banking business. To have the Mortgage Economic Review emailed to you each month, click here.

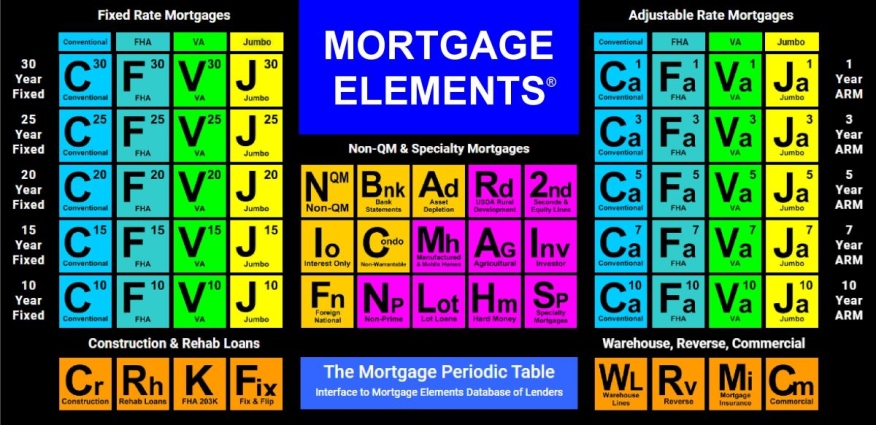

Discover New Lending Opportunities at MortgageElements.com, where you can explore over 300 Wholesale, Correspondent, Warehouse, Reverse, Construction, and Rehab Mortgage Lenders from one website. Use the Mortgage Periodic Table to research Mortgage Products and connect with TPO Account Executives. It costs nothing to use. It is one of the industry's largest databases of Wholesale, Correspondent, Warehouse, Rehab, and Construction Lenders.