As inflation hits a 40-year high and mortgage rates rise, many people are focused on housing affordability. Indeed, increased interest rates over the past year have increased monthly mortgage payments by approximately 40 percent.

But rising interest rates can affect foreclosures, too. An unsung benefit of low interest rates over the past several years has been that many borrowers have avoided foreclosure. Now that rates are rising, the industry must figure out new ways to prevent losses to borrowers and lenders. A three-step waterfall method that offers payment relief without deferring substantial principal amounts could be an effective solution.

Low interest rates have helped two types of borrowers avoid foreclosure: borrowers at risk of delinquency, who could refinance to lower their monthly mortgage costs and extended their term, and borrowers who became delinquent, who could modify the terms of their mortgage to create an affordable payment.

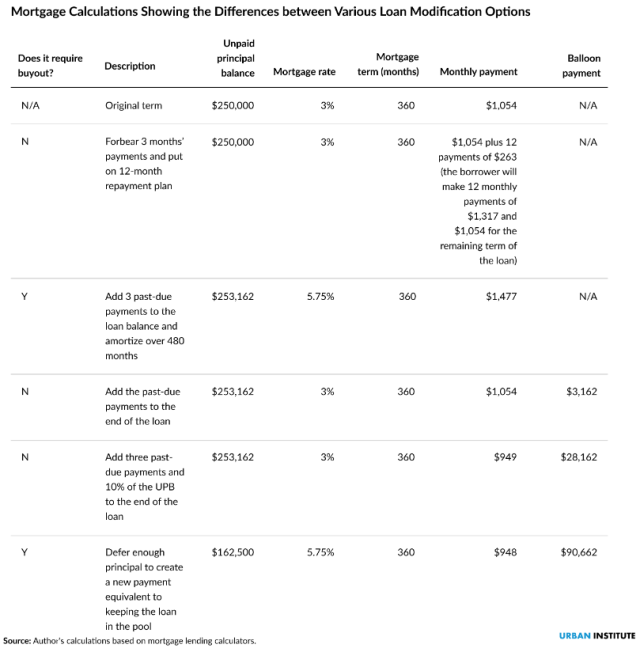

Low interest rates also helped prevent foreclosure through loan modifications. During the past 40 years of falling rates, mortgage-backed securities (MBS) issuers bought loans out of MBS pools and modified them to lower borrowers’ monthly payments and capitalize delinquent mortgage payments. These issuers included the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, as well as the approximate 430 issuers of Ginnie Mae guaranteed MBS.