Mortgage Originations Continue To Contract, Analysts Say

However, originations and economy should improve starting in 2024.

- Housing prices still climbing

- Unemployment at historic lows

- Economy expected to recover in 2024-25

The mortgage origination market will continue to contract dramatically through the remainder of 2023. That's the consensus of two prominent experts who closely follow the mortgage industry.

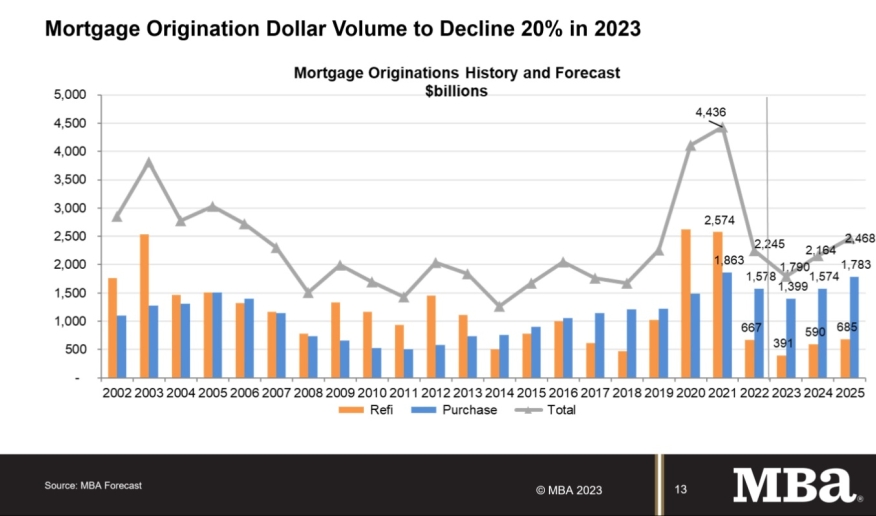

During their annual economic update Wednesday, Mike Fratantoni, chief economist with the Mortgage Bankers Association (MBA) and Tom Davis, chief sales officer for Deephaven Mortgage, agreed the mortgage origination volume is expected to decline 20% by the end of this year.

But there is a light cutting through the darkness.

“Within the housing market, we think we’re going to see a recovery in 2024,” Fratantoni said. “Some of that is derived from lower mortgage rates we’re expecting. With the recovery of the housing market in 2024 and 2025, expect those purchase unit numbers to increase as well as the dollars,” Fratantoni said.

Pre-tax net production income for independent mortgage banks is also at a loss for the 4th straight quarter, coupled with an approximate 20% decline in industry employment.

Home prices continue to rise, at least everywhere but California and basically the entire West Coast. Analysts attributed this to the fact that the tech companies in those states have halted hiring.

Davis recalled their 2022 and 2021 update events taking place in a vastly different market from the current one. Davis pointed out. “In Q1 of 2021 over 70% of the market was refinance transactions. Today it’s in the 20s; we’re in a purchase market.”

In addition, mortgage rates have gone from between 2% and 3% to between 6% and 7%.

Wednesday’s discussion preceded the Federal Reserve's announcement of a 25-basis-point interest rate hike. At a range of 5.25% to 5.50%, the central bank’s benchmark rate hit its highest level since the 2008 financial crisis.

In raising rates, the Fed’s plan was to bring down inflation, eventually.

Homebuilders are picking up some of the housing supply slack. “Typically, you’d expect 10% of homes to be new construction; now it’s 25 to 30% - a much larger piece of the pie than we’re used to seeing,” Fratantoni added.

The Non-QM mortgage market is doing well, Davis told their audience. “We’ve seen a large uptick in Non-QM production,” he said. “The adoption rates have picked up and we expect the sector to continue to grow.”

In part, this is due to a rise in non-typical borrowers. “Per census data, 16.2 million self-employed people in the U.S. account for over 20 million businesses,” Davis said. “That’s the highest in 10 years.”

The U.S. will likely enter a recession before returning next year.

“Given the affordability challenges so many borrowers are facing, we’re expecting a pretty significant slowdown in the U.S. economy and a modest recession,” Fratantoni said.

This is already occurring in Europe, which entered a technical recession by Q1 of 2023, when the gross domestic product (GDP) fell by 0.1%.

Headline inflation, as reported in the Consumer Price Index (CPI), is currently down to 3% year over year, with core inflation down to 4.8%. The Fed’s goal is to hit the 2% mark.

“How much of inflation is due to the wage-price spiral effect?” Fratantoni asked. “The fact that the job market is strong, employers have to keep increasing wages, passing on cost in terms of higher prices to their customers.”

David is optimistic about next year’s economic outlook. “As rates settle down and balance out, I think the market in 2024 and 25 will improve,” Davis said.

Unemployment rates are still low, at 3.6% nationally this month but expected to rise to 4.8% by the end of this year. “Then, as the economy recovers later in 2024, we’ll see more robust job growth once again,” Fratantoni said.

“The good news we have for you, because of the strong job market and strong price gain, we have seen delinquency rates reach an all-time low in the third quarter of 2022,” Fratantoni said.