Mortgage Rate Locks Dropped In May Across All Sectors

New information released by MCT Data shows purchase locks dropped last month.

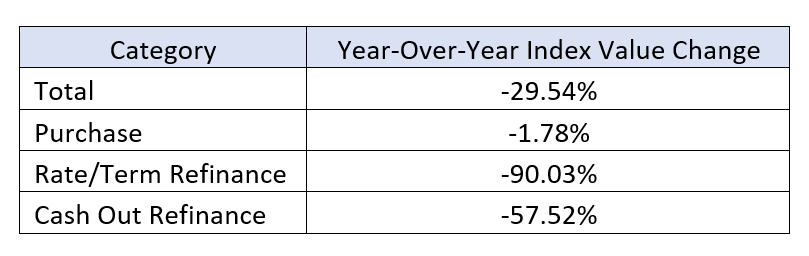

Mortgage rate locks across all categories dropped in May, according to research by MCT Data. Total rate lock volume year-over-year is down 29.5%.

Rapid rises in rates have kept would-be borrowers on the sidelines in 2022, MCT reported. Purchase locks are now on the decline, down 1.78% month-over-month and 10.1% from a year ago. The increase in mortgage rates is also evident, as refinance volume continues to fall. Rate/term refinances are down 29.6% and cash out refinances are down 9% month-over-month.

The May MCTlive! Lock Volume Indices, which include an adjustment for the Memorial Day holiday, show that total mortgage rate locks by dollar volume decreased 10.6% in May, and total lock volume is down 29.5% from a year ago as purchases now make up most of the volume. From one year ago, cash-out refinance volume is down 57.5%, while rate/term refinance volume has dropped 90%.

MCT said given rate/term refinance volume was already down 88% year-over-year in the April MCTlive! Lock Volume Indices, this month’s drop does not change the total much. However, loan sizes were up 8.3% over the past year, with the average loan amount increasing from $291,000 to $315,000.

MCT’s rate lock activity indices are based on actual dollar volume of locked loans, not number of applications. The company notes that, especially in a tight purchase market, MCT believes its methodology (using actual loans locked vs. applications) is a more reliable metric. There is a higher likelihood of having multiple applications per funded loan, and prequals do not convert at as high of a rate in the current market as has historically been the case — especially when applications are counted at the early stage of entering a property address.