Mortgage Rates Inch Upward To 7.18%

Homebuyers advised to shop around.

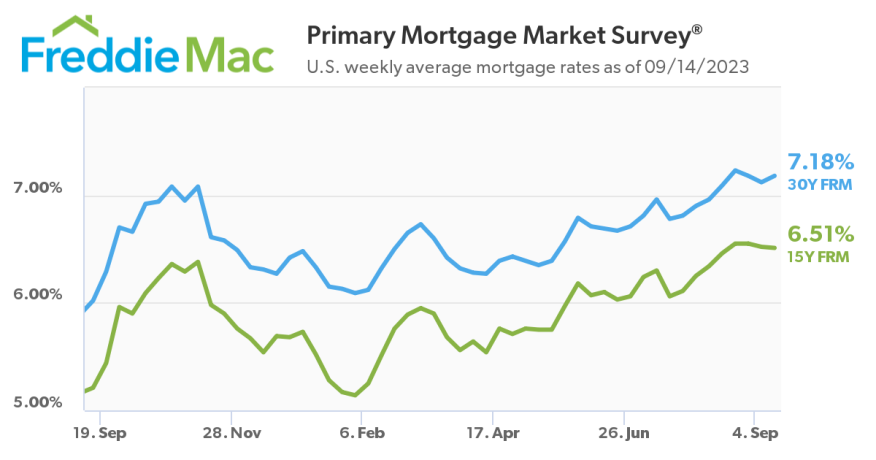

Freddie Mac says that the 30-year fixed-rate mortgage (FRM) inched up 5 basis points this week to 7.18%. In comparison, a year ago, the 30-year FRM was significantly lower, averaging 6.02%.

“Mortgage rates inched back up this week and remain anchored north of 7%,” Freddie Mac's Chief Economist Sam Khater said. “The reacceleration of inflation and strength in the economy is keeping mortgage rates elevated. However, potential homebuyers can still benefit during these times of high mortgage rates by shopping around for the best rate quote. Freddie Mac research suggests homebuyers can potentially save $600-$1,200 annually by applying for mortgages from multiple lenders.”

In addition to the 30-year FRM, the 15-year FRM also saw some movement, albeit in the opposite direction. It averaged 6.51%, slightly down from the previous week's rate of 6.52%. Comparatively, a year ago, the 15-year FRM stood at 5.21%.

These mortgage rate fluctuations continue to play a pivotal role in the housing market, impacting affordability and the decisions of potential homebuyers and existing homeowners looking to refinance. As rates hover above the 7% mark, consumers are navigating the real estate landscape carefully and keenly considering interest rate trends.