Mortgage Rates Rise For 2nd Straight Week

Freddie Mac says 30-year fixed rate rose to 6.32%, highest since Jan. 12.

- The 30-year fixed-rate mortgage averaged 6.32% as of Feb. 16, up from 6.12% last week.

- The 15-year fixed-rate mortgage averaged 5.51%, up from 5.25% last week.

Mortgage rates increased for the second consecutive week, returning to the level seen five weeks ago.

According to the Freddie Mac’s Primary Mortgage Market Survey (PMMS), released Thursday, the 30-year fixed-rate mortgage (FRM) averaged 6.32%, a 20-basis-point increase and the highest the rate has been since it was 6.33% on Jan. 12.

“Mortgage rates moved up for the second consecutive week,” said Sam Khater, Freddie Mac’s chief economist. “The economy is showing signs of resilience, mainly due to consumer spending, and rates are increasing. Overall housing costs are also increasing and therefore impacting inflation, which continues to persist.”

Mortgage Rates

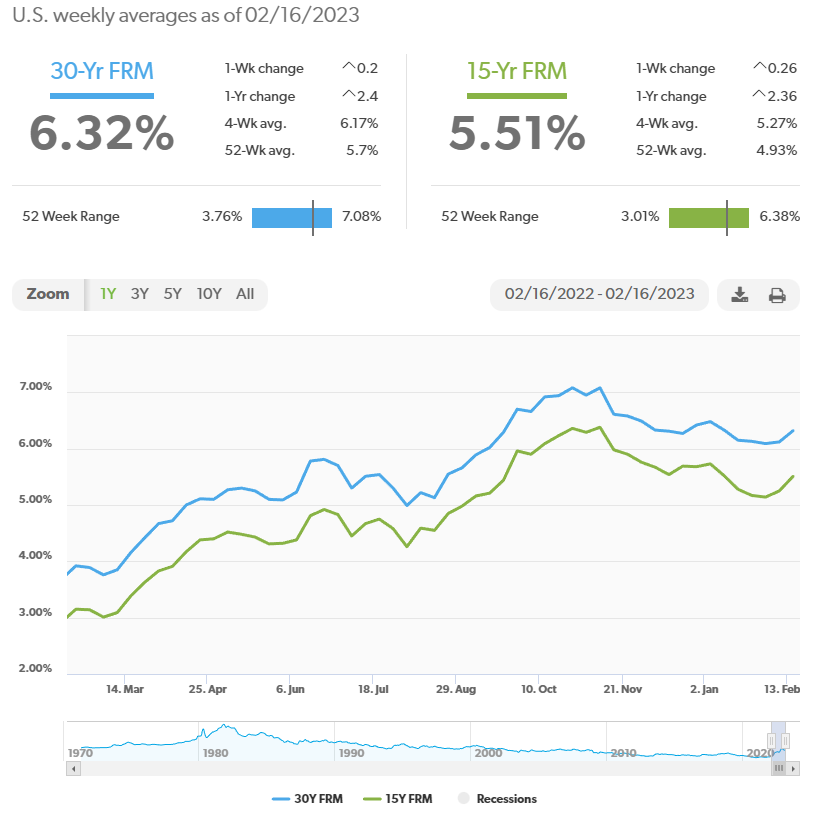

- The 30-year fixed-rate mortgage averaged 6.32% as of Feb. 16, up from 6.12% last week. A year ago, it averaged 3.92%.

- The 15-year fixed-rate mortgage averaged 5.51%, up from 5.25% last week. A year ago, it averaged 3.15%.

George Ratiu, manager of economic research for Realtor.com, said the 30-year fixed rate followed the increase in the 10-year Treasury.

“Investors are digesting the latest economic data, including the positive numbers released this week, such as retail sales, the Consumer Price Index, and the indices for small-business optimism and homebuilder sentiment,” Ratiu said. “While the Fed signaled that it will continue to raise rates this year, the moves are expected to come in 25-basis-point increments, a less aggressive tightening than what we saw in 2022. The central bank is acknowledging that it sees its monetary actions having a tangible effect on inflation. The CPI data out this week seems to confirm the bank’s views.”

The U.S Bureau of Labor Statistics issued its monthly report on consumer prices on Tuesday, with the Consumer Price Index rising 0.5% in January on a seasonally adjusted basis. That was up from a 0.1% increase in December, but it met analysts’ expectations.

Over the past 12 months, the all-items index increased 6.4% before seasonal adjustment, down slightly from a 6.5% annual increase reported in December and the smallest 12-month increase since the period ending October 2021.

Ratiu said that, even with the CPI data, many companies continue to expect the economy to enter a recession as a result of the Fed’s rate hikes, even in the face of data pointing to continued resilience.

“This expectation is becoming more visible in the growing number of companies resorting to layoffs as a hedge against a potential economic slowdown,” he said. “The real challenge may come from companies’ reaction, as a rising number of people losing their jobs may turn expectations into a self-fulfilling prophecy.”

People who are laid off pull back on spending, he noted, “and even those who are still employed may begin to do the same due to worries about losing their job, thus potentially sending consumer spending into a downward spiral.”

Ratiu said he expects mortgage rates to move in the 6%-to-7% range over the next few weeks. “For housing markets, the rebound in rates translates into higher mortgage payments, adding pressure on homebuyers," he said.