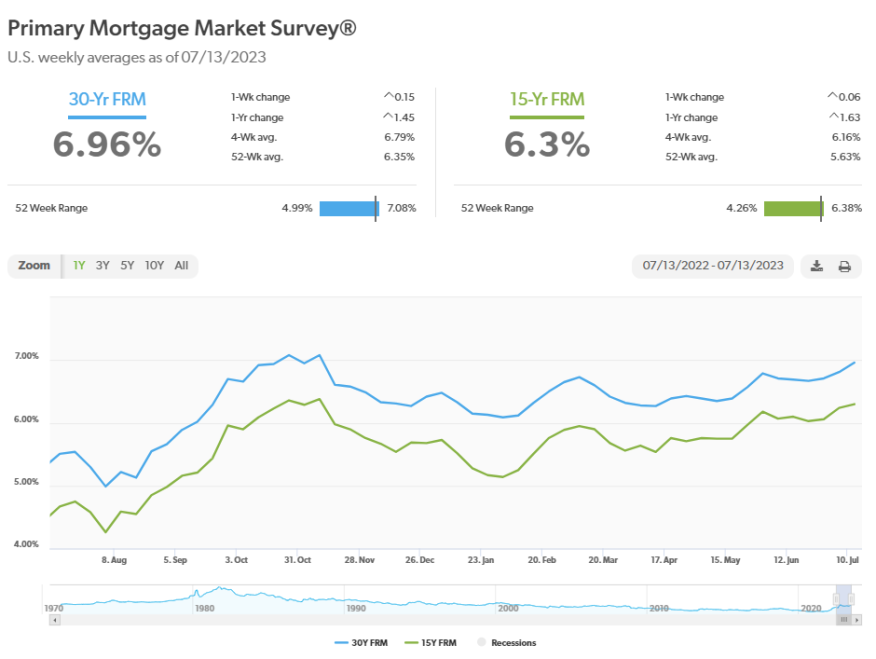

Mortgage Rates Rise For 3rd Straight Week, Approach 7%

Both the 30-year and 15-year fixed mortgages reach their highest levels since November.

- 30-year fixed mortgage increased to 6.96% from 6.81% a week earlier.

- 5-year fixed-rate mortgage averaged 6.3%, up from 6.24% last week.

Mortgage rates increased for the third straight week this week, rising to levels not seen in eight months, Freddie Mac said Thursday.

The government-sponsored enterprise released its Primary Mortgage Market Survey (PMMS), showing that:

- The 30-year fixed-rate mortgage averaged 6.96% as of July 13, up from 6.81% last week. It averaged 5.51% a year earlier.

- The 15-year fixed-rate mortgage averaged 6.3%, up from 6.24% last week and up from 4.67% a year earlier.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

“Mortgage rates increased to their highest level since November 2022, the last time rates broke 7%,” said Freddie Mac Chief Economist Sam Khater.

The 30-year fixed mortgage average is at its highest since Nov. 10, when the rate was 7.08%. That same week, the 15-year fixed mortgage averaged 6.38%.

“Incoming data suggest that inflation is softening, falling to its lowest annual rate in more than two years,” Khater said. “However, increases in housing costs, which account for a large share of inflation, remain stubbornly high, mainly due to low inventory relative to demand.”

The U.S. Bureau of Labor Statistics on Wednesday released its latest Consumer Price Index (CPI) report, showing that annual inflation had fallen to 3% in June.

On a monthly basis, the CPI increased 0.2% in June, up from 0.1% a month earlier. The largest contributor to the monthly rate was the index for shelter, accounting for over 70% of the increase, the BLS said.

Still, as Realtor.com Economist Jiayi Xu noted, the headline inflation rate continued to cool in June, rising 0.2% from May and up 3% from a year ago, the smallest annual increase since March 2021.

“The core inflation rate, excluding volatile food and energy prices, slid to 4.8%, registering the slowest annual growth since October 2021,” she said. “More importantly, the 0.2% monthly increase in core inflation aligns with a 1.9% annual rate of change if sustained, the lowest since February 2021. Looking ahead, we may continue to expect the inflation slowdown as the growth in the shelter index, the largest contributor to inflation growth, passed its peak in April and has since been on a downward trend.”

While the improvement in inflation is encouraging, the level itself is still well above the Federal Reserve’s 2% target, Xu said.

“In addition, the strong job market will continue to drive demand in the economy, fuel price increase, and contribute to higher inflation,” she continued. “As a result, it is still highly likely that an additional rate hike will occur later in July.”

She noted, though, that the encouraging inflation data could be used as a basis for another "wait-and-see" approach during the Feds meeting later this month, which could help reverse the recent increase in mortgage rates.

“This, in turn, would create a more favorable environment for those looking to purchase a home in the coming fall season,” Xu said.