Mortgage Rates Slightly Retreat, Holding Above 7%

Freddie Mac's latest report shows a modest decline in 30-year fixed-rate mortgages to 7.18%, though they remain well above the 7% threshold.

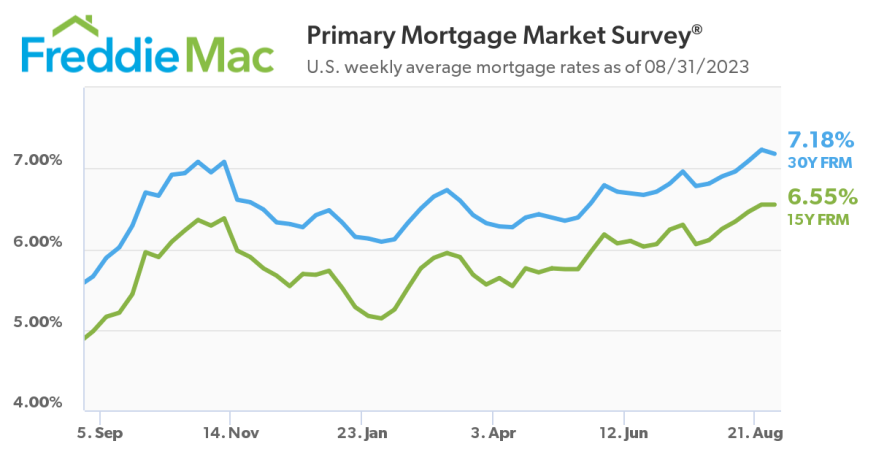

In a climate of uncertainty, Freddie Mac's recent release of its Primary Mortgage Market Survey revealed that the 30-year fixed-rate mortgage (FRM) has stabilized at an average of 7.18%. While this marks a slight decrease from the previous week's average of 7.23%, it still represents a notable increase from the 5.66% average recorded a year ago.

“Mortgage rates leveled off this week but remain elevated. Despite continued high rates, low inventory is keeping house prices steady,” Freddie Mac Chief Economist Sam Khater said. “Recent volatility makes it difficult to forecast where rates will go next, but we should have a better gauge in September as the Federal Reserve determines their next steps regarding interest rate hikes.”

The PMMS data also revealed that the 15-year FRM remained unchanged from the previous week at an average of 6.55%. A year ago at this time, the 15-year FRM averaged 4.98%.

This stability in rates over the past few weeks suggests a potential trend of steadying mortgage rates across different loan terms.

It's important to note that the PMMS focuses specifically on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit. The data is indicative of the conditions within this segment of the market.