Mortgage Rates Stabilize Amid 23-Year Highs

Federal Reserve holds steady, but housing market challenges persist with scarce inventory and rising listing prices.

Mortgage rates displayed some stability this week, with the Federal Reserve opting to maintain its rates, a decision announced on Wednesday. Even with this holding pattern, mortgage rates are situated at a high not seen in 23 years.

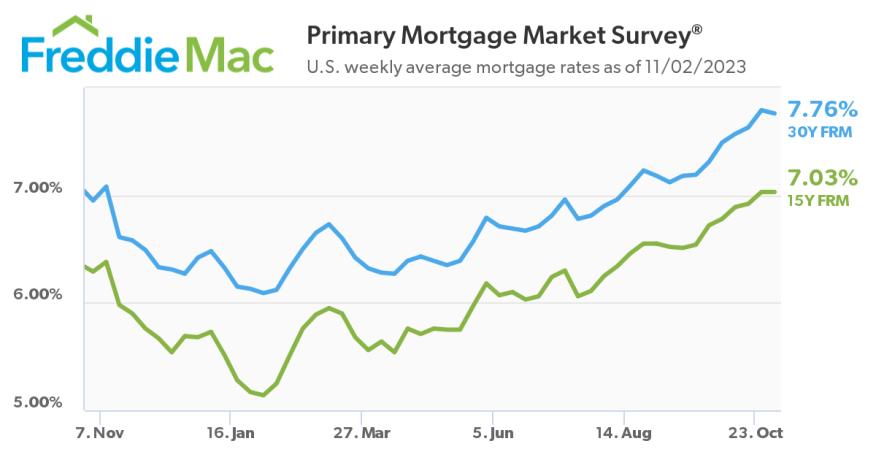

Freddie Mac reported Thursday that the 30-year fixed-rate mortgage averaged 7.76% on Nov. 2. This is a subtle drop from the 7.79% of the preceding week but a notable increase from 6.95% recorded during the corresponding period last year.

“The 30-year fixed-rate mortgage paused its multi-week climb but continues to hover under 8%,” Freddie Mac’s Chief Economist Sam Khater said. “The Federal Reserve again decided not to raise interest rates but have not ruled out a hike before year-end. Coupled with geopolitical uncertainty, this ambiguity around monetary policy will likely have an impact on the overall economic landscape and may continue to stall improvements in the housing market.”

A significant influence on mortgage rates is the performance of the 10-year Treasury yield, which has recently been registering historic highs.

In a recent development, the U.S. Treasury Department declared its intention to decelerate the rate of its long-term debt issuance, even though the overall issuance is expected to rise.

Hannah Jones, an economic research analyst at Realtor.com, said "The shift in bond issuance did not take significant pressure off of longer-dated bond yields, but neither did it apply much additional pressure."

She said the lack of information to fuel another jump in mortgage interest rates is "relatively positive, even if the underlying conditions to warrant falling rates have not yet been achieved."

However, it doesn't necessarily move the needle for today's buyers who face scarce inventory and still-high listing prices.

"Both active listing and new listings fell year-over-year in October, prices climbed, and homes spent slightly less time on the market, which, combined with high mortgage rates, means home shoppers are facing higher housing payments and tighter market conditions this fall," she added.