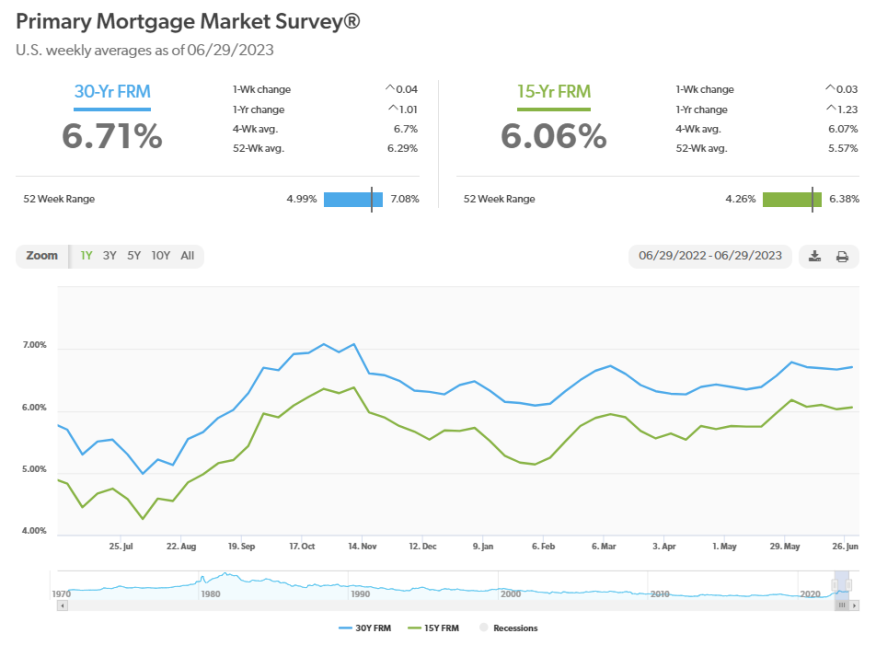

Mortgage Rates Tick Up After 3 Weeks Of Declines

The 30-year fixed mortgage rate averaged 6.71% this week.

- The 30-year rate has moved within a narrow range between 6.39% and 6.79% since mid-April.

- The 15-year fixed-rate mortgage averaged 6.06%.

Mortgage rates increased for the first time in four weeks, as both the 30- and 15-year fixed rates rose at least 3 basis points, Freddie Mac said Thursday.

According to the government-sponsored enterprise’s weekly Primary Mortgage Market Survey (PMMS):

- The 30-year fixed-rate mortgage averaged 6.71% as of June 29, up 4 basis points (bps) from last week when it averaged 6.67%. The rate is back where it was on June 8. A year ago at this time, it averaged 5.7%.

- The 15-year fixed-rate mortgage averaged 6.06%, up 3 bps from last week when it averaged 6.03%. A year ago it averaged 4.83%.

The average for the 30-year fixed mortgage has moved within a narrow range between 6.39% and 6.79% since mid-April, according to Freddie Mac PMMS data.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

“Mortgage rates have hovered in the 6% to 7% range for over six months and, despite affordability headwinds, homebuyers have adjusted and driven new home sales to its highest level in more than a year,” said Sam Khater, Freddie Mac’s chief economist. “New home sales have rebounded more robustly than the resale market due to a marginally greater supply of new construction. The improved demand has led to a firming of prices, which have now increased for several months in a row.”

George Ratiu, chief economist of Keeping Current Matters, a real estate insights and analytics company, said that with the economy and job markets still expanding, housing is experiencing a period of stabilization.

“Sales of existing homes are steady, and inventory remains tight,” he said.”Meanwhile, new home transactions are rising, as buyers seek alternatives to a small supply of existing properties. The supply-demand dynamic is pushing prices higher and underscoring the return of historical seasonality. These trends point toward a new balance in real estate, especially with mortgage rates keeping a steady pace for 10 consecutive months.”

For homeowners who must move, Ratiu said, “the current market offers the benefit that a sale is likely to result in an attractive price. Many would-be sellers who worried about last year’s price correction are seeing neighbors fetch competing offers and solid closing prices.”.

On the other hand, he said. “For buyers who are looking for a home, a growing number of new houses at somewhat more affordable prices is compounding the modest improvement in existing inventory. At the same time, local market conditions are more nuanced this year, requiring more effort to find value in what remains an affordability-constrained environment. For the typical homebuyer there’s no escape from the reality that the mortgage payment for a median-priced home is $2,300.”