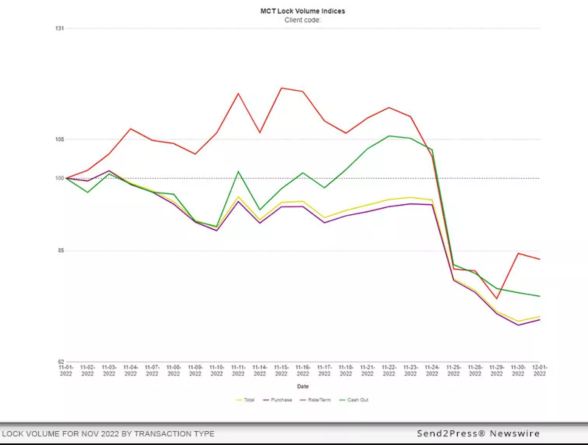

November Mortgage Rate Lock Volume Fell 61% YOY

The volume of both rate/term and cash-out refi locks was down more than 86% YOY.

Overall mortgage rate lock volume in November fell nearly 61% from a year earlier, led by a big decline in refinance locks, as mortgage rates rose and housing affordability continued to fall.

Mortgage Capital Trading Inc. (MCT), a capital markets software and services provider for lenders, published its monthly MCTLive! Lock Volume Index for November, which showed that lock volume fell 60.9% from a year earlier.

The report showed:

- Both the month-over-month rate/term refinance lock figure and purchase index decreased for the second consecutive month.

- Total mortgage rate locks by dollar volume decreased 28.6% month-over-month in November.

- Rate/term refinance volume in November dropped 92% from a year earlier.

- Cash out refinances were down 24.4% month-over-month, and 86.8% from a year earlier.

While lock volumes fell, MCT noted that loan sizes increased more than 8% over the past year, with the average loan amount at $317,000, up from $292,000 a year earlier.

MCT said its data represents a “balanced cross section” of several hundred retail, correspondent, wholesale, and consumer direct lenders. “A broad-based view of the entire market provides a more accurate picture of mortgage originations versus indices that are influenced by mega lenders,” it said.

It is important to note, MCT added, that its rate-lock activity indices are based on actual dollar volume of locked loans, not the number of applications, which the company said it believes is a more reliable metric, especially in a tight purchase market.

“There is a higher likelihood of having multiple applications per funded loan, and (pre-qualifications) do not convert at as high of a rate in the current market as has historically been the case — especially when applications are counted at the early stage of entering a property address.”

Founded in 2001, offers mortgage pipeline hedging, execution loan sales, business intelligence and analytics, outsourced lock desk solutions, MSR valuation, hedging, bulk sales, and the world’s first ”truly open” marketplace for loan sales.

Based in San Diego, MCT also has offices in Healdsburg, Calif.; Philadelphia; and Texas.