OCC: 97% Of First-Lien Mortgages Were Current In 3Q

The percentage of seriously delinquent mortgages continued to drop.

- The percentage of seriously delinquent mortgages continued to drop this quarter to 1.3%.

- Servicers initiated 9,835 new foreclosures in the third quarter, still a higher volume than last year.

The performance of first-lien mortgages in the federal banking system improved during the third quarter of 2022, according to the Office of the Comptroller of the Currency (OCC) Mortgage Metrics Report, released Thursday.

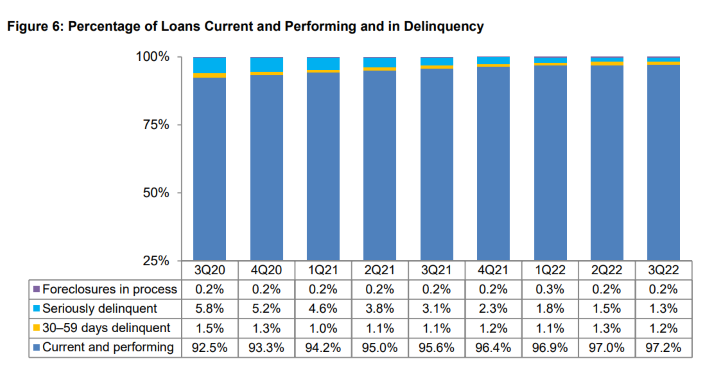

The OCC said that 97.2% of mortgages included in the report were current and performing at the end of the quarter, compared to 95.6% just one year ago.

The percentage of seriously delinquent mortgages — mortgages that are 60 or more days past due and all mortgages held by bankrupt borrowers whose payments are 30 or more days past due — continued to drop. It was 1.3% in the third quarter of 2022, compared to 1.5% in the prior quarter and 3.1% a year ago.

Servicers initiated 9,835 new foreclosures in the third quarter of 2022. While that’s a decrease from the second quarter, it’s a higher volume than a year earlier. The new foreclosure volume in the third quarter of 2022 is lower than pre-COVID-19 pandemic foreclosure volumes, the OCC said.

Servicers completed 16,160 modifications during the third quarter, a 42.5% decrease from the second quarter. Of the modifications completed during the quarter, 11,696 (72.4%) reduced the loan's pre-modification monthly payment.

Combination modifications — modifications that included multiple actions affecting the affordability and sustainability of the loan, such as an interest rate reduction or a term extension — represented 15,037 or 93.1%.

The first-lien mortgages included in the OCC's quarterly report comprise 22% of all residential mortgage debt outstanding in the United States. That’s approximately 12 million loans totaling $2.7 trillion in principal balances, the OCC said.

The report provides information on mortgage performance through Sept. 30, and is available on the OCC's website.