Overall Mortgage Delinquency Rate Hit All-Time Low In March

CoreLogic said the serious delinquency rate fell to 1.1%, the lowest level in 23 years.

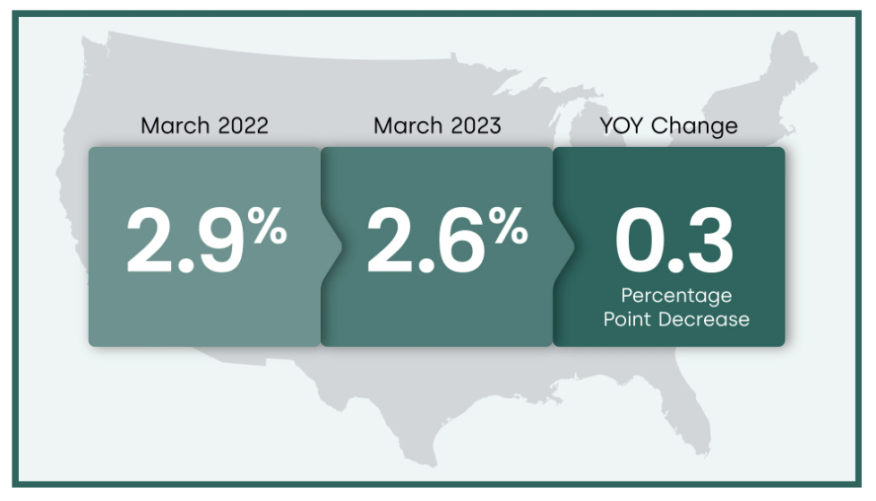

- In March, 2.6% of all mortgages in the U.S. were in some stage of delinquency, down 0.3 percentage points YOY.

The U.S. mortgage delinquency rate declined to a new low in March, buoyed by an exceptionally strong job market, CoreLogic said Thursday.

Nationwide, serious delinquencies also dropped to the lowest level in more than two decades in March, while foreclosures also remained near a historic low.

According to CoreLogic’s monthly Loan Performance Insights (LPI) report for March 2023, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.3 percentage point decrease compared with 2.9% in March 2022, and a 0.4 percentage point decrease compared with 3% in February 2023.

As in previous months, several metro areas on Florida’s Gulf Coast continued to see elevated serious delinquency rates as a result of the lingering effects of last fall’s Hurricane Ian.

Despite regular news of major layoffs — particularly in the tech sector — April’s 3.4% unemployment rate remained near an all-time low, indicating that many workers who recently lost jobs were able to quickly find new positions, enabling them to stay current on their mortgage payments.

Unemployment At 50-Year Low

“The U.S. mortgage delinquency rate fell to a historic low in March, reflecting the lowest U.S. unemployment rate in more than 50 years,” said Molly Boesel, principal economist for CoreLogic. “While a slowing economy could cause increases in job losses and mortgage delinquencies, years of home-equity gains will provide borrowers who fall behind on their payments with a cushion.”

Boesel added that the equity should protect many homeowners from foreclosures. “There is no current projection that the U.S. foreclosure rate will reach the same level as it did during the housing crisis more than a decade ago,” she said.

CoreLogic examines all stages of delinquency. In March, the U.S. delinquency and transition rates and their year-over-year changes were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.1%, unchanged from March 2022.

- Adverse Delinquency (60 to 89 days past due): 0.3%, unchanged from March 2022.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.1%, down from 1.5% in March 2022 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from March 2022.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.5%, unchanged from March 2022.

State and Metro Takeaways

No state posted an annual increase in overall delinquency rates in March. The states with the largest declines were Alaska (down by 0.9 percentage points) and New York (down by 0.8 percentage points). The other states' annual delinquency rates dropped between 0.7 and 0.1 percentage points.

- In March, 20 U.S. metro areas posted an increase in overall delinquency rates. Cape Coral-Fort Myers, Fla. (up by 1.3 percentage points) topped the list, followed by Punta Gorda, Fla. (up by 1.1 percentage points) and Bloomsburg-Berwick, Pa. (up by 0.7 percentage points).

- All but three U.S. metro areas posted at least a small annual decrease in serious delinquency rates (defined as 90 days or more late on a mortgage payment) in February. Metros that saw serious delinquencies increase were Cape Coral-Fort Myers (up by 1.1 percentage points), Punta Gorda (up by 1 percentage point) and Bloomsburg-Berwick, (up by 0.1 percentage point).

Data in the CoreLogic LPI report represents foreclosure and delinquency activity reported through March 2023, the company said. The data accounts for only first liens against a property and does not include secondary liens. The delinquency, transition, and foreclosure rates are measured only against homes that have an outstanding mortgage. CoreLogic has approximately 75% coverage of U.S. foreclosure data.