PennyMac Posts Solid Q2 Results Amid Market Volatility

Diversified business model, rising production volumes, and large servicing portfolio propel the company to profitability.

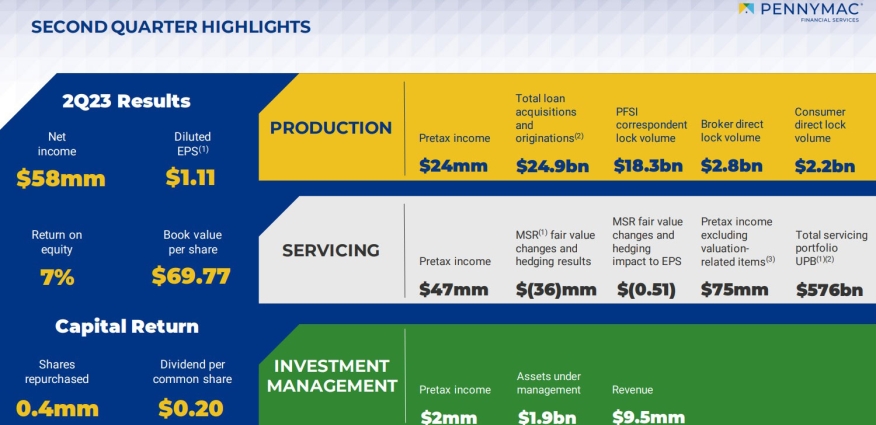

PennyMac Financial Services Inc. touted its diversified business model for its second-quarter net earnings of $58.3 million. That's a 91.7% increase over the first quarter but a year-over-year decrease of 54.8%.

PennyMac Chairman and CEO David Spector noted the increased production volumes and profitability from the previous quarter, in addition to a substantial contribution from its growing servicing portfolio.

However, these gains were partly offset by net valuation-related losses resulting from an inverted yield curve and high hedge costs due to multi-year highs in interest rate volatility. The book value per share increased to $69.77 at the end of the quarter.

The company recorded an annualized return on equity of 7% for the quarter, with net income totaling $58 million, equating to $1.11 in earnings per share. PennyMac also repurchased $26 million worth of common stock during this period.

"Our leading correspondent lending activities continue to drive the organic growth of our servicing portfolio by adding loans at prevailing mortgage rates, which we expect will provide meaningful opportunities for our consumer direct division in future periods when rates decline," Spector said.

In the earnings call, Spector emphasized that PennyMac's balanced business model is distinct, with production returning to profitability due to increased volumes and margins, and a robust operating performance in its servicing segment. He proudly announced that in the first quarter, PennyMac was the largest producer of mortgage loans in the country.

The second quarter saw a 9% rise from the previous quarter in total production volumes, including acquisitions made by PMT, amounting to $24.9 billion in unpaid principal balance (UPB). PennyMac's servicing portfolio concluded the quarter at over $576 billion in UPB, driven by these volumes and multi-year low prepayment speeds.

However, the investment management segment reported a slight decrease, with net assets under management totaling $1.9 billion at the end of the quarter.

According to Spector, the recent financial performance indicates that mortgage banking firms with large servicing portfolios and diversified business models are better positioned to counter the decline in profitability resulting from low origination volumes. He pointed out that PennyMac's large servicing portfolio has generated $1.3 billion in revenue from servicing and sub-servicing fees over the last year.

The company's multi-channel production approach is seen as a unique competitive advantage, and its commitment to the broker channel has led to more partnerships, higher volumes, and an increase in market share in recent periods.

Despite interest rates still hovering in the high sixes, Spector expressed optimism for the future. He stated that PennyMac is extraordinarily well-positioned given its large and balanced business model, robust capital, and strong liquidity management disciplines. It is expected that the company's return on equity will return to its pre-COVID range during 2023.