PMI Profits Remain High As Housing Market Cools

U.S. private mortgage insurance (PMI) hit record profitability in the second quarter of 2022.

- Despite record profitability, new insurance written (NIW) in the first half of 2022 was down 27% from the first half of 2021.

- Although higher interest rates will lower new business production, they will further improve persistency rates on the mortgage insurers’ in-force portfolios.

- Home-price gains in recent years provide the PMIs with an equity cushion on insured mortgages that should keep claim rates low.

- In the first half of 2022, PMIs generated around $225 billion of NIW, a 19% decrease from the second half of 2021.

A new report from Moody’s Investors Service shows U.S. private mortgage insurance (PMI) hit record profitability in the second quarter of 2022, driven by lower incurred losses and increased persistency as refinance activity declined leading to a growth in insurance-in-force.

Persistency rates are the percentage of an insurance company's already written policies remaining in force, without lapsing, being replaced by policies of other insurers, or other changes.

Despite record profitability, new insurance written (NIW) in the first half of 2022 was down 27% from the first half of 2021, reflecting the slowdown in mortgage originations as interest rates rose to the highest level since 2008.

Although higher interest rates will lower new business production, they will further improve persistency rates on the mortgage insurers’ in-force portfolios and will support incrementally higher net investment income as new money is invested at higher rates. Capital adequacy remains strong throughout the sector, with firms continuing to return a portion of excess capital to shareholders through dividends and share buybacks.

Macroeconomic Conditions Shifting

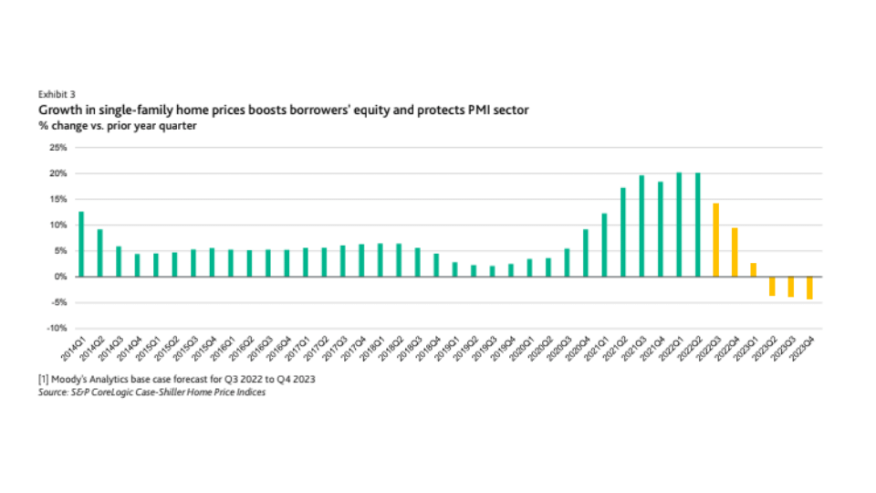

U.S. housing market fundamentals have been relatively strong. Existing-home prices are expected to increase nationwide by about 8% over the current year before falling off by the end of 2023.

The U.S. housing market is now cooling off, as higher mortgage interest rates and inflation have impacted housing affordability. Yet, labor trends remain strong with the U.S. employment rate of 3.6% in the second quarter of 2022, the lowest reading since the fourth quarter of 2019.

More Profitability

In the second quarter of 2022, pre-tax operating income was up by 10.5% from the previous quarter, as earnings rose following the decrease of loss reserve provisions.

The amount of loans curing continues to outpace new default notices, with total delinquent loans as a percentage of policies in force marking a 27-month low at 1.9%. In the first half of 2022, PMIs generated around $225 billion of NIW, a 19% decrease from the second half of 2021 primarily driven by a decline in refinance activity.

Capitalization Remains Strong

Although there is an increased focus on returning capital to shareholders through dividends and share buybacks, holding company liquidity remains strong at the end of the first half of 2022.

Private mortgage insurer eligibility requirements (PMIERs) sufficiency ratios benefited from strong earnings and improving credit qualify, supported by robust reinsurance activity through the issuance of excess-of-loss reinsurance, quota-share reinsurance, and insurance-linked notes.

Key Findings & Forecasts

- Q2 2022 marks the second consecutive quarter of declining real GDP.

- Moody forecasts U.S. real GDP growth of 1.9% for 2022 and 1.3% for 2023.

- Rising mortgage rates will continue to dampen new demand and slow house price appreciation.

- Home-price gains in recent years provide the PMIs with an equity cushion on insured mortgages that should keep claim rates low.

- Though a correction in home prices is possible, the market is likely to remain supported by the fundamental housing strengths such as favorable demographic trends and constrained housing supply.