Rate Lock Volume Fell 22% in April: Black Knight

While there were 3 fewer business days in April, there were still additional signs of a slowdown.

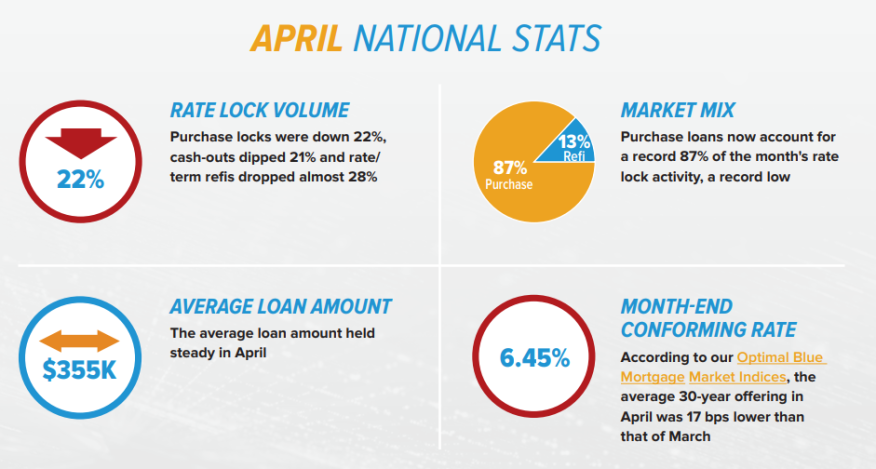

- Purchase locks fell 22%.

- Cash-out refinance locks fell 21%.

- Refinance locks down 28%.

Rate-lock volumes declined more than 20% in April, even though mortgage rates trended lower during the month, Black Knight said Monday.

The software, data, and analytics company released its latest Originations Market Monitor report, looking at mortgage origination data through the end of April 2023.

Based on its daily rate lock data from Black Knight Optimal Blue PPE, rate-lock volumes fell 22% in April from March.

"Despite the fact that mortgage rates on average were lower in April, rate lock volumes took a hit," said Andy Walden, vice president of enterprise research and strategy at Black Knight. "From March to April, volumes were down 22%, even though the average rate in April was 17 basis points lower than that of March. While half the decline can be explained by the fact that there were three fewer business days in April than in March, we clearly saw additional cooling in rate lock volumes this month."

Down Across The Board

Locks were down across the board, with purchase locks down 22%; cash-out refinance locks falling 21%, and rate/term refinance locks down 28%.

Purchase locks accounted for more than 87% of locks in April, the highest share on record. Even so, purchase lock counts were down 45% year over year and were 38% below April 2019.

"After seeing purchase rate locks pull to within 15% of pre-pandemic levels in mid-January and again in mid-March on easing rates, we've seen that deficit eclipse 30% again in recent weeks," Walden said.

He said there appear to be a number of reasons for that.

"In addition to fewer business days in April than in March, another component may be potential homebuyers waiting on the sidelines for more favorable rates before locking,” Walden said. “We saw a similar phenomenon on the rate dips in March. Inventory challenges are surely playing a role as well.”

He noted that the volume of new listings remained well below pre-pandemic levels, and that the active for-sale inventory fell for the sixth consecutive month on a seasonally adjusted basis.

“Lock volumes will be worth watching closely in coming weeks to see if this trend continues," he said.

Each month's Originations Market Monitor provides origination metrics for the U.S. and the top 20 metropolitan statistical areas by share of total origination volume.

Other Highlights

- The Optimal Blue Mortgage Market Indices showed 30-year conforming rates dipping below 6.25% in the first week of April before finishing at 6.45%, for an average of 6.38% for the month, 17 basis points lower than March's average

- The 10-year Treasury yield ended April at 3.44%, pushing the spread with mortgage rates back above 3%, nearing its high point since the Fed began raising rates last year

- Rate lock volumes fell 22% month over month, with half the change attributable to March having three additional business days; adjusted for these calendar effects, April volumes dropped just 10%

- The refi share of lock volume dipped to 12.8%, setting a new floor for refi production

- Conforming loans took share from all other loan products in April, while FHA saw the biggest drop — a rare pullback since FHA began regaining share in late 2021, when it held 10% of total volume

- Purchase lock counts were down 45% year over year; 38% below those in pre-pandemic April 2019

- Average loan amount remained flat at $355,000, while the average purchase price rose slightly from $445,000 to $447,000

- Credit quality ticked higher across the board, with purchase, cash-outs, and rate/term refis all picking up 2 points on average

- The adjustable-rate mortgage share dropped to 7.8% of all lock volume, down from 8.8% in March