Redfin: $2.3T In Home Values Lost In 2nd Half Of ‘22

Bay Area housing market lost the most in percentage terms.

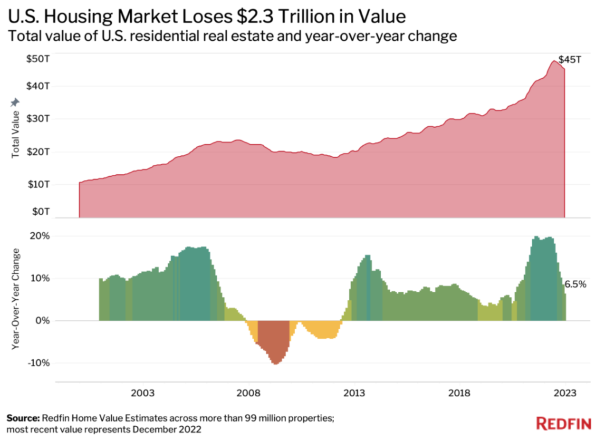

The total value of U.S. homes combined was $45.3 trillion at the end of 2022, down $2.3 trillion, or 4.9%, from a record high of $47.7 trillion in June, according to a new report.

Redfin, the technology-powered real estate brokerage, said the nearly 5% decline was the largest June-to-December drop in percentage terms since 2008.

While the total value of U.S. homes was up 6.5% from a year earlier in December, it was the smallest year-over-year increase for any month since August 2020.

The housing market has been shedding value because homebuyer demand has waned, which has also caused home prices to fall from their peak, Redfin said. The median U.S. home sale price was $383,249 in January, down 11.5% from a peak of $433,133 in May and up just 1.5% from January 2022.

Homebuyer demand slowed in large part because rising mortgage rates — a consequence of the Federal Reserve’s effort to curb inflation — made purchasing a home more expensive, Redfin said. The average 30-year fixed mortgage rate was 6.36% in December; while that was down from the 20-year high of 7.08% in November, it's roughly double the level from the start of 2022.

Rates fell at the beginning of February, giving buyers some hope, but have since crept back up to December levels.

“The housing market has shed some of its value, but most homeowners will still reap big rewards from the pandemic housing boom,” said Redfin Economics Research Lead Chen Zhao. “The total value of U.S. homes remains roughly $13 trillion higher than it was in February 2020, the month before the coronavirus was declared a pandemic.”

Zhao said a lot of potential homebuyers were left behind. “Many Americans couldn’t afford to buy homes, even when mortgage rates hit rock bottom in 2021, which means they missed out on a significant wealth building opportunity,” she said.

Bay Area’s Hardest Hit

The total value of San Francisco homes fell 6.7% year over year to $517.5 billion in December — a $37.3 billion decline, and the largest drop in percentage terms for any major U.S. metropolitan area.

San Francisco was followed by two other Bay Area markets: Oakland (-4.5%) and San Jose (-3.2%). Only three other metros saw year-over-year declines: New York (-1%), Seattle (-0.4%), and Boise, Idaho (-0.3%). Redfin said its analysis includes the 100 most populous metro areas, with the exception of Albuquerque, N.M.,, which had insufficient data.

While that’s bad news for homeowners in the Bay Area, it’s good news for buyers — home prices are down and competition remains far lower than it was during the pandemic boom. San Francisco’s median home sale price dropped 9.4% year over year to $1.3 million in January, the second biggest decline in the country.

For sellers, the silver lining is that the steep decline in prices has lured some buyers back to the market.

“Three of my listings recently went under contract after sitting on the market for more than a month,” said Ali Mafi, a Redfin real estate agent in San Francisco. “They all had a few showings here and there in the fall, but no buyer wanted to pull the trigger. And then suddenly in the new year, we had 10 or 15 people touring each property.”

Florida Holds Value

The total value of homes in Miami rose 19.7% year over year ($77 billion) to $468.5 billion in December — the largest annual increase in percentage terms among the metros Redfin analyzed. Miami’s housing market had roughly the same value in December as it did when it peaked in July at $472 billion.

It was followed by North Port-Sarasota, Fla. (+17.8%); Knoxville, Tenn.(+17.7%); Charleston, S.C. (+17.4%); and Lakeland, Fla. (+16.9%). Florida was home to six of the 10 metros with the largest annual home-value gains, in percentage terms, even after Hurricane Ian caused billions of dollars in damage and displaced thousands of Floridians in fall 2022.

“Florida’s housing market is being sustained by folks moving in from the North and as of recently, the West Coast,” said Elena Fleck, a Redfin real estate agent in Palm Beach. “People are pouring in from New Jersey and New York, in large part because Florida has relatively affordable homes and no income tax. They can get a lot more bang for their buck here.”

Suburbs Fare Better

The total value of homes in American suburbs rose 6.4% year over year to $25.4 trillion in December, Redfin said. By comparison, the value of urban homes climbed 2.5% to $10.8 trillion. Rural homes — which make up a relatively small portion of the housing market — also fared better than cities, with total home value increasing 8.5% to $6.2 trillion.

The suburbs came back into vogue during the pandemic, while cities fell out of favor — largely due to the shift to remote work and the housing affordability crisis.