Redfin: Bidding War Rates Drop Despite Fewer Buying

The 'New Weird': Mortgage rates surge and bidding wars drop as more people choose not to buy a home.

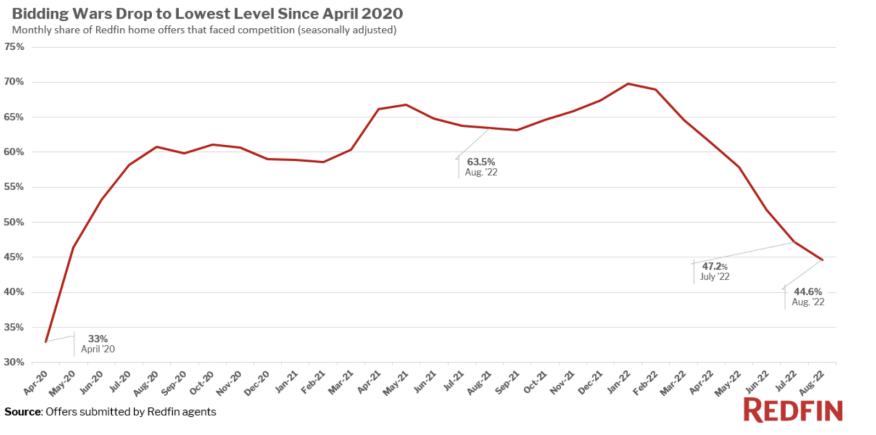

- Bidding wars are down from 63.5% a year earlier and a revised rate of 47.2% in July, marking the seventh-straight monthly decline.

- As of Sept. 18, the median home sale price was $371,850, up 8% year over year.

Nationwide, 44.6% of home offers written by Redfin agents faced competition on a seasonally adjusted basis in August, the lowest bidding-war rate since the beginning of the pandemic in 2020, when the housing market nearly ground to a halt.

That's down from 63.5% a year earlier and from a revised rate of 47.2% in July, marking the seventh-straight monthly decline.

The typical home in a bidding war received 3.2 offers in August, compared to 3.5 in July and 5 a year earlier, according to data submitted by Redfin agents nationwide. The bidding-war rate is falling as the housing market cools and buyers back off from the pandemic-driven home-buying frenzy in 2021 and early 2022.

Redfin agents reported that many prospective buyers have backed off because they can’t afford the high monthly payments that come with 6%-plus mortgage rates. Inflation also has an impact on the declining pool of buyers.

The good news for buyers is that, even though they’re paying higher mortgage rates than they were last year, they’re less likely to face competition and homes are priced slightly lower than they were at the peak of the market.

Buyers, however, aren’t so convinced. In a new Redfin report, few people are choosing to buy homes with mortgage rates well above 6% and home prices increasing 1% in the last two weeks after 11 weeks of declines. As of Sept. 18, the median home-sale price was $371,850, up 8% year over year.

Even fewer homeowners want to sell, with touring activity showing a 13% decline since the start of the year. The seasonally adjusted Redfin Homebuyer Demand Index — a measure of requests for home tours and other home-buying services from Redfin agents — was down 15% year over year.

“There has been a lot of talk of a ‘new normal,’ but what’s happening in the housing market feels more like a ‘new weird,’” said Redfin Deputy Chief Economist Taylor Marr. “The impact of the Fed’s inflation-curbing strategy is seen clearest in the housing market as prospective buyers take a big step back, slowing sales. But since the vast majority of homeowners who might consider moving have a mortgage rate far below current levels, there’s very little new supply hitting the market."

As a result, he said, "home-sale prices have picked up in recent weeks, and the typical buyer’s monthly mortgage payment is just a few pumpkin spice lattes shy of its all-time high. The irony is that it may take renewed fears of a recession to bring some relief to buyers in the form of lower prices.”

Other takeaways:

- Pending home sales were down 21% year over year, the largest decline since May 2020.

- 34% of homes that went under contract had an accepted offer within the first two weeks on the market, little changed from the prior four-week period but down from 40% a year earlier.

- The bidding-war rate declined in all 36 metros in this analysis except Philadelphia, the metro with the highest rate. The rate there is up from 60.2% a year ago.