Redfin: Home Bidding Wars At Lowest Level In Over 2 Years

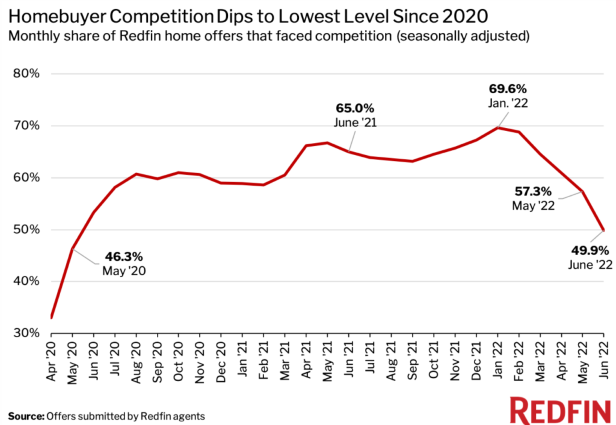

The competition rate dipped below 50% in June for the first time since the start of the pandemic.

- The 49.9% of offers that faced competition in June was the lowest share since May 2020 and the first time the bidding-war rate has been below 50% since that month.

- June’s bidding-war rate compares with a revised rate of 65% one year earlier, and 57.3% one month earlier.

- It was the fifth-straight monthly decline in the bidding war rate.

Less than half of the home offers written nationwide by Redfin agents faced competition on a seasonally adjusted basis in June, according to a new report from Redfin.

The technology-powered real estate brokerage said the 49.9% of offers that faced competition in June was the lowest share since May 2020 and the first time the bidding-war rate has been below 50% since that month, when the housing market was at a near standstill due to the onset of the coronavirus pandemic.

June’s bidding-war rate compares with a revised rate of 65% one year earlier, and 57.3% one month earlier, Redfin said. It also marks the fifth-straight monthly decline.

Housing-market competition is declining because higher mortgage rates, high home prices, inflation, and a falling stock market have eroded homebuyer budgets, causing some house hunters to drop out of the market, Redfin said.

Roughly 60,000 home-purchase agreements were called off in June, equal to 14.9% of homes that went under contract that month. That’s the highest percentage on record, with the exception of the start of the pandemic, Redfin said. The typical monthly mortgage payment for a homebuyer is now $2,387 at the current 5.51% mortgage rate, up 44% from a year ago.

“While the market is cooling, it’s not coming to a crashing halt,” said Shoshana Godwin, a Redfin real estate agent in Seattle. “House hunters who can still afford to buy should consider taking advantage of the slowdown given that there’s way less competition.”

Competition By Region

In Riverside, Calif., 31.9% of home offers written by Redfin agents faced competition in June, down from 70.5% a year earlier. That 38.6-percentage-point decline was the largest among the 36 U.S. metropolitan areas in this analysis.

Next came Raleigh, N.C. (38.9% vs. 74.1%; a 35.2-percentage-point drop), Charlotte, N.C. (48.1% vs. 80%; -31.9 ppts), Seattle (41.4% vs. 71.6%; -30.2 ppts), and Honolulu (38.9% vs. 69%; -30.2 ppts).

“Showings have dramatically decreased. Homes that would’ve had 20 showings two months ago are now getting one or even none,” said Jenny Dedrick, a Redfin real estate agent in Minneapolis, where the bidding-war rate fell to 45.7% in June from 65% a year earlier. “I had one seller take his home off the market because it only got one showing. He decided to rent it out instead. He’s moving to Mexico and thought, ‘why not let it sit and keep appreciating?’”

Competition increased on a year-over-year basis in just two of the 36 markets Redfin analyzed. In Colorado Springs, Colo., 55.9% of home offers written by Redfin agents faced competition in June, up from 45.9% in June 2021 (+10 ppts). In Providence, R.I., the bidding-war rate rose slightly, to 77.6% in June from 77.1% a year earlier — but that rate was higher than any other metro area in Redfin’s analysis, it said.

Providence’s high rate was followed by Boston (71.7%), Philadelphia (65.7%), Indianapolis (64.3%), and Worcester, Mass. (62.7%).

Tampa, Fla., had the lowest bidding-war rate, at 28.9%. Rounding out the bottom five were Riverside, Calif., (31.9%), Phoenix (35.3%), Honolulu (38.9%), and Raleigh, N.C. (38.9%).

Townhouses were more likely than any other property type to encounter bidding wars, with 54.6% of Redfin offers facing bidding wars in June, the company said. Next came single-family homes (52.3%), followed by condos/co-ops (47%) and multi-family properties (41.3%).