Redfin: New Listings Spike Up And Inventory Improves

More sellers are listing their homes, but mortgage rates and steep home prices are suppressing sales.

- Active listings remained flat at 763,254, marking the first time active listings haven’t posted a year-over-year decline since June 2023.

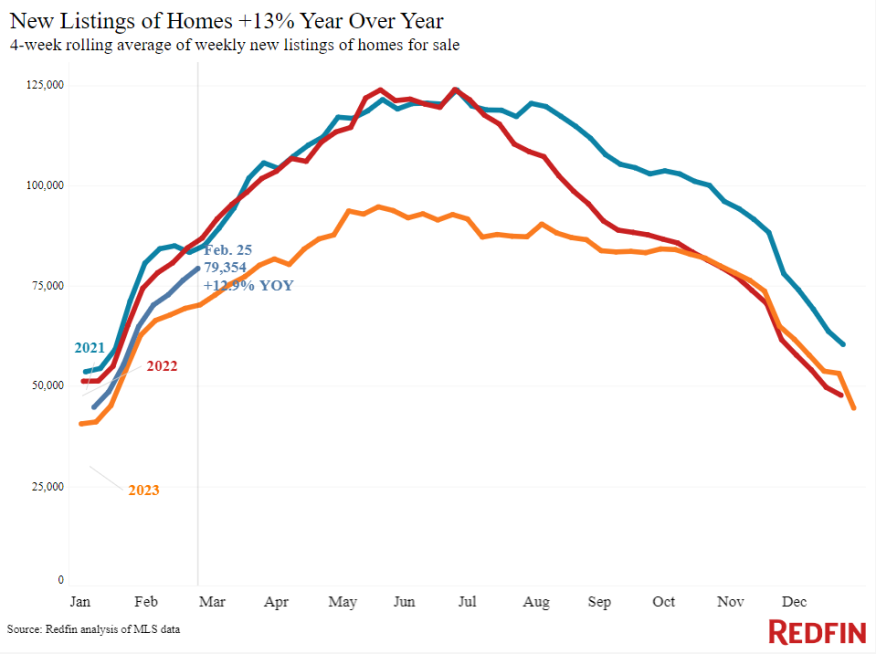

New listings of U.S. homes for sale rose 13% year over year during the four weeks ending February 25, marking the biggest increase in nearly three years. That’s according to a new report from Redfin.

Other details in the report point to improving inventory, with active listings flat at an unchanged 763,254 – the first time active listings haven’t posted a year-over-year decline since June 2023. Months of supply ticked up 0.2 points to 3.9 months. For context, four to five months of supply is considered balanced, with a lower number indicating seller’s market conditions.

While the news of improving inventory may come as a relief to prospective buyers, Redfin points out that while buyers have a few more homes to choose from, they’re still facing historically high housing costs. The typical homebuyer’s mortgage payment is $2,671, just $47 shy of last October’s record high.

High costs crunched pending sales down 8%, the biggest decline in five months, and mortgage-purchase applications declined for the fourth straight week. Despite the declines, more house hunters are searching as more homes hit the market. Redfin’s Homebuyer Demand Index shot up 10% from a month ago to its highest level since last September. Albeit, that number is still down 9% year over year.

Redfin says pending sales could improve in the next few months if rates don’t increase further and new listings continue to rise.

“House hunters are out there, and competition picks up every time mortgage rates decline a bit,” said Brynn Rea, a Redfin Premier agent in Spokane, WA. “I’m telling buyers who can afford it to look now while they have more breathing room and less competition. They have a good chance of negotiating the price down or getting some concessions from the seller, which could make up for getting a 7% mortgage rate instead of 6%.”

To put these measurements into perspective, Redfin noted that the median sale price for the four weeks ending February 25 was $365,888, a 5.4% increase since the same time last year and the biggest increase since Oct. 2022 (with the exception of the 4 weeks ending Feb. 11, when there was a 5.5% increase).