Share of Loans In Forbearance Ticks Up In October

MBA estimates that 350,000 homeowners are seeking assistance.

The number of loans now in forbearance ticked up just slightly in October from a month earlier, the Mortgage Bankers Association (MBA) said Monday.

According to the MBA’s monthly Loan Monitoring Survey, conducted Oct. 1-31, 2022, loans in forbearance increased 1 basis point to 0.7% of servicers’ portfolio volume as of Oct. 31, up from 0.69% in September. MBA estimated that 350,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance also increased 1 basis point, to 0.31%, MBA said. Ginnie Mae loans in forbearance increased 8 basis points to 1.41%.

The forbearance share for portfolio loans and private-label securities (PLS), however, declined 11 basis points to 1.03%.

“The overall share of loans in forbearance increased slightly in October, but it was a mixed bag by investor type,” said Marina Walsh, CMB, MBA’s vice president of industry analysis, who noted the increase in the forbearance rate for Ginnie Mae, Fannie Mae, and Freddie Mac loans, while there was a decline in portfolio and PLS loans in forbearance.

“Several factors were behind the first monthly increase in forbearances in 29 months,” Walsh said, “including the effects of Hurricane Ian in the Southeast, the diminishing number of loans bought out of Ginnie Mae pools and placed in portfolio, and the fact that new forbearance requests have closely matched forbearance exits for the past three months.”

MBA’s Loan Monitoring Survey asks servicers to report all loans in forbearance regardless of the borrower’s stated reason — whether pandemic-related, due to a natural disaster, or other cause.

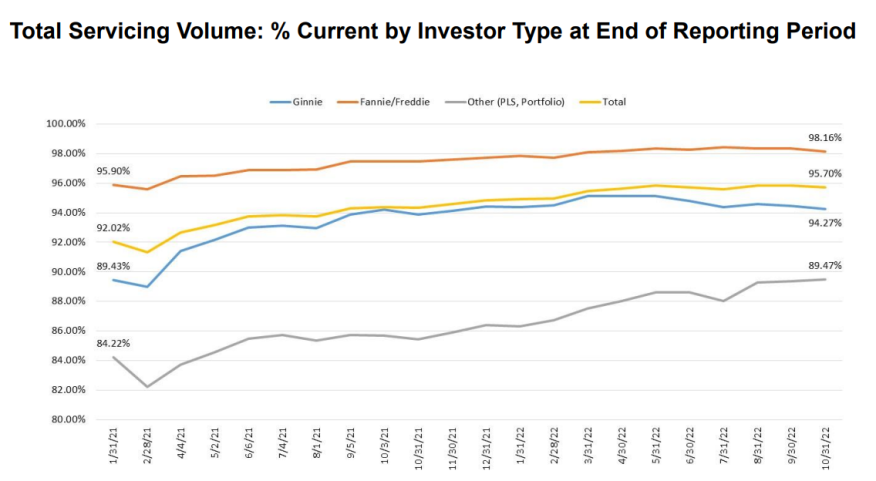

“The overall share of loans that were current last month decreased 15 basis points to 95.7%, with 44 states reporting declines (not delinquent or in foreclosure),” Walsh said. “Florida, which was hit the hardest by Hurricane Ian, experienced a 49-basis-point drop in the share of loans that were current — the biggest decline of all states.”

By stage, 36.7% of total loans in forbearance are in the initial forbearance plan stage, while 50.9% are in a forbearance extension, the MBA said. The remaining 12.4% are forbearance re-entries, including re-entries with extensions.

Other Key Findings:

Of the cumulative forbearance exits for the period from June 1, 2020, through Oct. 31, 2022, at the time of forbearance exit:

- 29.6% resulted in a loan deferral/partial claim.

- 18.3% represented borrowers who continued to make their monthly payments during their forbearance period.

- 17.3% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 16% resulted in a loan modification or trial loan modification.

- 11% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 6.6% resulted in loans paid off through either a refinance or by selling the home, and

- The remaining 1.2% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

Loans in forbearance as a share of servicing portfolio volume (#) as of Oct. 31:

- Total: 0.7% (previous month: 0.69%).

- Independent Mortgage Banks (IMBs): 0.96% (previous month: 0.95%).

- Depositories: 0.47% (previous month: 0.48%).

MBA’s monthly Loan Monitoring Survey covers the period from Oct. 1-31, 2022, and represents 66% of the first-mortgage servicing market (32.9 million loans).