S&P CoreLogic Reports A 19.7% Annual Gain For May

The gain was down from 20.6% in April.

- The 10-City Composite annual increase came in at 19%, down from 19.6% in April.

- The 20-City Composite posted a 20.5% year-over-year gain, down from 21.2% in the previous month.

- U.S. National Index posted a 1.5% month-over-month increase in May.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. census divisions, reported a 19.7% annual gain in May, down from 20.6% in the previous month.

The 10-City Composite annual increase came in at 19%, down from 19.6% in the previous month. The 20-City Composite posted a 20.5% year-over-year gain, down from 21.2% in the previous month.

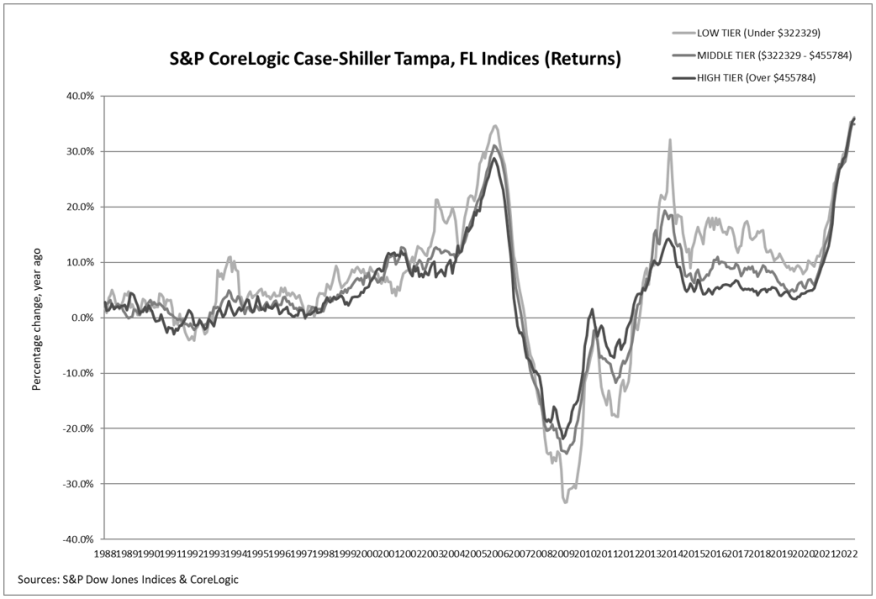

Tampa, Miami, and Dallas reported the highest year-over-year gains among the 20 cities in the index in May. Tampa led with a 36.1% year-over-year price increase, followed by Miami with a 34% increase, and Dallas with a 30.8% increase.

Four of the 20 cities reported higher price increases in the year ending May 2022 versus the year ending April 2022.

“Housing data for May 2022 continued strong, as price gains decelerated slightly from very high levels,” said Craig J. Lazzara, managing director at S&P DJI. “Despite this deceleration, growth rates are still extremely robust, with all three composites at or above the 98th percentile historically.”

Before seasonal adjustment, the U.S. National Index posted a 1.5% month-over-month increase in May, while the 10-City and 20-City composites posted increases of 1.4% and 1.5%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1%, and the 10-City and 20-City Composites both posted increases of 1.3%. In May, all 20 cities reported increases before and after seasonal adjustments

“The market’s strength continues to be broadly based, as all 20 cities recorded double-digit price increases for the 12 months ended in May. May’s gains ranked in the top quintile of historical experience for 19 cities, and in the top decile for 17 of them,” Lazzara said. “However, at the city level we also see evidence of deceleration. Price gains for May exceeded those for April in only four cities. As recently as February of this year, all 20 cities were accelerating.”