Survey: 46% Of U.S. Adults Say We’re In A Recession

Morning Consult finds many Americans want to take actions to prepare for a recession, but can't.

Economists and business owners can debate all they want about when the U.S. economy will enter a recession. If you ask adults in the U.S., nearly half of them think it already has.

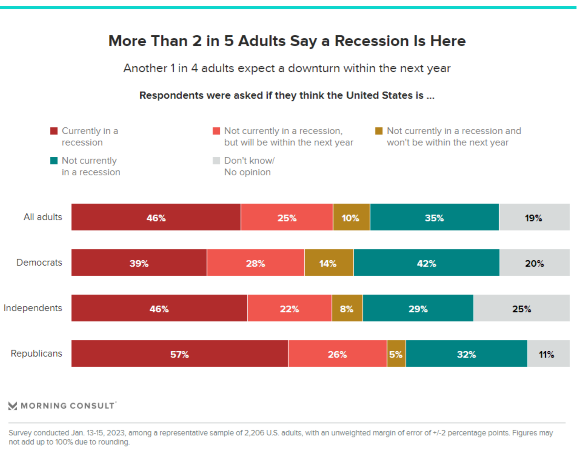

That’s according to a new survey conducted by Morning Consult, which found that 46% of U.S. adults believe the country is currently mired in a recession, while another 25% expect one within the next year.

The survey was conducted Jan. 13-15 among a representative sample of 2,206 U.S. adults, with an unweighted margin of error of plus or minus 2 percentage points, Morning Consult said.

Republicans were the most convinced of an economic downturn, with 57% saying the country is currently in a recession and 26% expecting one within the next year. Only 5% said we are not currently in a recession and won’t be within a year.

By comparison, 46% of Independents and just 39% of Democrats say the country is currently in a recession, the survey found.

Other highlights:

- Among adults who said the economy is their top concern, 51% believe the country is currently in a recession, and 24% believe the United States will experience one within the next year.

- Adults in households with differing incomes had similar views on whether the country is currently experiencing a downturn: 46% of those making less than $50,000 a year said the country is currently in a recession, compared to 48% of those making $50,000-$100,000 and 42% of those earning more than $100,000 annually.

In addition, much of the public wants to prepare for a recession, but says they can’t.

According to the survey, half of U.S. adults said they have not actively taken steps to prepare for a recession, but wish they could.

- Adults living in households with incomes over $100,000 a year were the most likely to have taken action, with 41% saying they are preparing for a downturn.

- While 36% of men said they had taken steps to prepare for a downturn, 27% of women said the same. But women were more likely to wish they could prepare, with 58% saying they wanted to but couldn’t prepare, compared with 41% of men who wished they could prepare.

- Among adults who said the economy is their biggest concern, 35% said they have prepared for a recession, while 13% haven’t because they don’t want or need to, and another 52% haven’t but wish they could.

The latest economic data offered some signs of relief from inflation, even leading some Federal Reserve officials to say they may support easing their interest rate hike strategy. Consumers, though, are still feeling the pain of rising prices. Morning Consult said its latest consumer spending report noted a 4.3% decline in spending in December, with 21.3% of U.S. adults saying their monthly expenses exceeded their monthly income.