Survey Reveals ARM Borrowers Regret Decision

Financial strain looms for borrowers who made a choice to go with an ARM.

A new survey finds that a significant portion of adjustable-rate mortgage (ARM) borrowers regret their decision to opt for these loans due to recent spikes in interest rates. Despite this, many plan to stick with their ARMs, facing potential financial strain.

The report from home equity investment platform Point found that approximately 70% of ARM holders, including those in introductory and variable-rate phases, now regret their choice. Rising interest rates, soaring above two-decade highs since 2022, have altered the financial landscape for ARM borrowers significantly.

Among the few survey respondents who said they plan to exit their ARM, 39% plan to refinance into a fixed-rate mortgage at the end of their ARM’s fixed-rate period. Of those homeowners, 71% said they don’t know if their monthly mortgage payment will increase or decrease once they switch to a fixed rate.

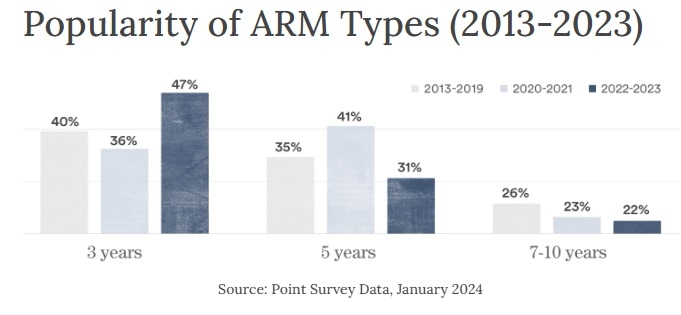

Point's January research surveyed borrowers who obtained ARMs between 2013 and 2023. Historically, ARMs become more popular in higher-rate environments, aiming to lower initial monthly payments.

At the beginning of the 10-year period in February 2013, the average 5/1 ARM rate stood at 2.63%, dropping to a low of 2.37% in December 2021. However, as these borrowers transition from fixed terms, rates may rise significantly. For instance, rates tied to the current benchmark Secured Overnight Financing Rate (SOFR) could increase to 5.9% this year and potentially surge to 7.3% in 2025.

Despite the potential for substantial increases in monthly payments over the next two years, an overwhelming 82% of respondents plan to retain their ARMs. Reasons for this decision vary, with limited options for borrowers whose circumstances have changed, including difficulties in refinancing due to missed payments.

Refinancing into a 30-year fixed mortgage might not be feasible for those who have missed payments and seen their credit scores suffer. Even among those considering refinancing, there appears to be a lack of detailed knowledge about the terms and potential outcomes.

While the surge in mortgage rates caught many borrowers off guard, the rate of home equity accrual over the past three years offers some assistance. However, with loans with 3-year fixed introductory periods being the most popular type of ARMs in recent years, borrowers face uncertainty amid the shifting financial landscape.