Half Of All Loan Applicants Denied Since 2022 Rate Hikes

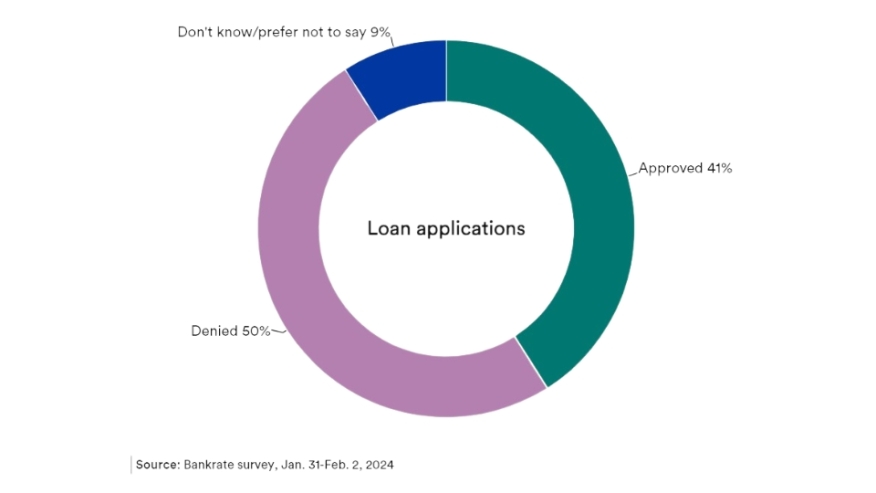

Bankrate survey finds 50% of Americans who’ve applied for a loan or financial product since March 2022 have been denied.

Half of Americans who’ve applied for a loan or financial product have been denied since the Federal Reserve started raising its key benchmark rate in March 2022, and 17% have been denied more than one loan, according to a new Bankrate survey.

Credit lines are the main culprit to loan applicants getting denied, such as new credit cards (14%) and personal loans (10%), as they have become crucial for absorbing the cost of higher prices. Some Americans are even struggling to access financial products that could help pay off those balances quickly, such as balance transfer cards (6%) or debt consolidation loans (6%).

Slightly more than one in five Americans (21%) say that it’s gotten harder to obtain credit since the Fed began hiking borrowing costs, but that share surges to 50% for Americans who have credit scores considered “poor” (in the 300-579 range) and 38% for those with “fair” credit (580-669) on FICO’s scale.

Bankrate’s poll also found that more than eight in 10 Americans (82%) who have been denied say that the rejection negatively impacted their finances. To access the credit they need, nearly one in four rejected applicants (23%) pursued alternative financing, such as cash advances or payday loans, which come with even higher interest rates, up to 650%.

The possibility of being denied a loan also kept more Americans from applying. About one in seven (15%) who haven’t applied for loans or financial products since the Fed began raising interest rates say the reason they haven’t sought any financing is because they didn’t think they’d get approved. Another 17% say higher borrowing costs were what deterred them.

“Banks and other lenders are constantly mindful of the potential downsides of both the changing economic environment, as well as the risks that people get behind on payments — or worse,” said Bankrate Senior Economic Analyst Mark Hamrick. “One way they account for that is for financial service firms to hold on to more of their money.”

Bankrate also cites a January 2024 senior loan officer survey from the Federal Reserve, stating that almost a year after some of the largest bank failures in U.S. history, banks aren’t as skittish about lending money as they were immediately after the collapse of Silicon Valley and First Republic Bank.

In The Fed’s loan officer survey, a major net share of banks reported expectations for stronger loan demand this year. The most frequently cited reason was an expected decline in interest rates.

“Yet, accessing credit is still tougher today than it was before the pandemic — and by design,” Bankrate stated in a press release. “The tide may turn only if the U.S. economy continues to avoid a recession and the Fed eventually cuts interest rates.”

Other reasons banks gave for expecting stronger demand include: higher customer spending or investment needs, a shift of customers from other banks and nonbanks, and an expected decrease in precautionary demand for cash and liquidity.