Transunion: Mortgage Originations Decline For 8th Straight Quarter

Elevated interest rates drive down borrowing activity, while home equity provides relief amidst rising delinquencies.

The housing market has continued to show signs of slowing down as mortgage originations saw their eighth consecutive quarter of declining volume. This prolonged slump can primarily be attributed to elevated interest rates, which have made borrowing less attractive for potential homebuyers.

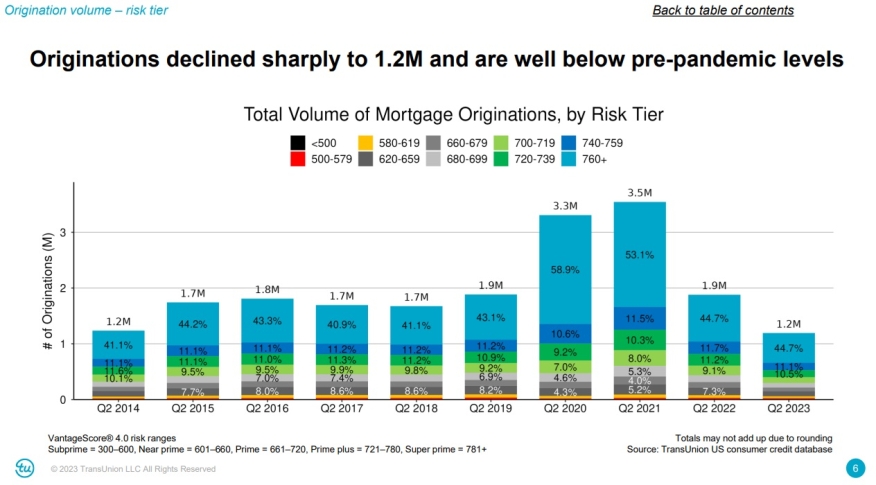

A new report from Transunion found that originations were down 37% year over year falling to 1.2 million, comparable to volumes seen in Q2 2014.

According to the latest data, mortgage originations in Q2 2023 remained well below pre-pandemic levels, continuing a trend that began in the wake of the COVID-19 pandemic. The primary driver of the decline in mortgage originations is the rise in interest rates, which has made borrowing more expensive.

In the second quarter of 2023, purchase volumes outpaced refinance volumes by a significant margin, with a ratio of 7 to 1. Purchase originations made up 87% of the overall volume share, suggesting that homebuyers are still active in the market despite the challenging lending conditions.

Despite the slowdown in origination growth, total mortgage balances managed to increase by 3% year-over-year, reaching $11.8 trillion in Q2 2023. This indicates that while fewer new mortgages are being taken out, the existing mortgage market is still expanding.

“Following a period of historically low account delinquencies, delinquencies have seen six consecutive quarters of YoY increases – inching them closer to pre-pandemic levels, "Joe Mellman, senior vice president and mortgage business leader at TransUnion, said. "Delinquencies increased across all stages (early, mid and late) and all loan types."

Mellman added: "Vintage performance, which reflects the performance of an account in different periods after the loan was granted, shows deterioration in more recent originations. New mortgage vintages are performing worse than vintages of the past four years.”

In the latest quarter, the average new loan amount growth remained flat year-over-year when compared to previous quarters. This suggests that home prices have moderated somewhat, providing some relief to potential buyers who may have been grappling with soaring housing costs in recent years.

While interest rates have been low by historical standards, delinquencies in mortgage accounts increased by 15% year-over-year in the same period. This uptick in delinquencies reflects the ongoing macroeconomic volatility that has put financial pressure on some homeowners.

Despite the challenges in the housing market, available home equity for mortgage holders continues to grow steadily. In Q2 2023, the aggregate total of available home equity reached approximately $19.7 trillion, marking a 1% year-over-year increase.

While overall home equity origination growth decreased year-over-year compared to the peak levels seen in 2022, home equity line of credit and home equity loan volumes remain robust. These volumes are notably higher than those observed between 2008 and 2021, indicating that homeowners leverage their equity for various financial needs.

"In the midst of increasing non-mortgage debt and rising delinquencies across the board, the record levels of equity available to homeowners will remain a viable solution to ease debt pressures," Mellman said.