US Home Investor Share Remained High in Early Summer 2023

Small investors continue to purchase properties in high numbers; large investor activity is back to pre-pandemic level

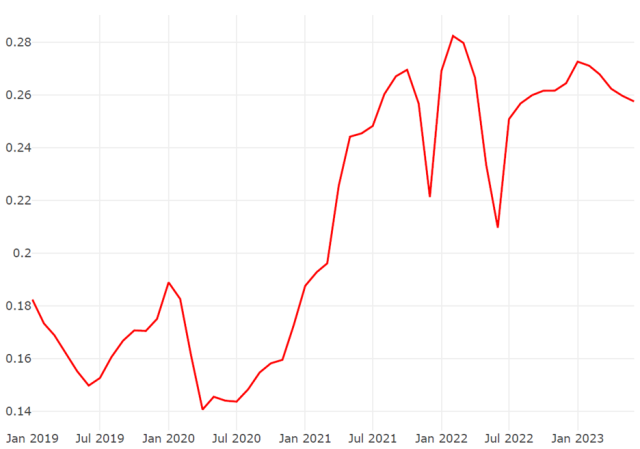

The sizable U.S. home investor share seen over the past two years held steady going into the summer. In March 2023, investors accounted for 27% of all single-family home purchases; by June, that number was almost unchanged at 26%.

That’s according to a new report authored by Thomas Malone of CoreLogic. The following text is from his report.

The figure below shows the share of home purchases made by investors since January 2019. The year 2021 saw a surge in investor activity. Investors have since held a market share that averages 8 percentage points higher than in 2020. Investor activity has declined slightly since early 2023, but there is still no sign that the share will fall back to its pre-pandemic level in the near future. Indeed, the most likely reason for the small drop in home investor purchases in recent months is seasonality, as owner-occupied buyers become more active in the summer.

Share of Homes Sold to Investors Versus Non-Investors Through Q2 2023

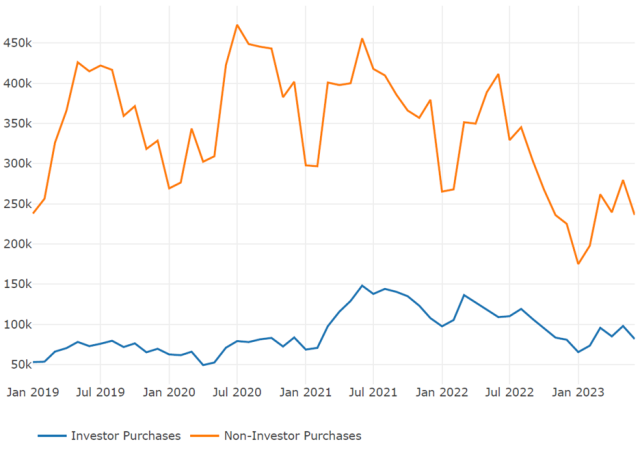

The next figure below illustrates the number of U.S. home purchases made by both investors and non-investors through March 2023. In April, May and June of 2023, home investors made 85,000, 98,000 and 82,000 purchases, respectively. Over the course of the second quarter, this was an annual decline of 90,000 purchases. However, when compared with the same months in 2019, the increase in home investor activity rose by more than 43,000. When comparing that number with non-investors, who made 392,000 fewer purchases in Q2 2023 than in Q2 2019, it becomes clear how different the current market is than it was in the previous few years.

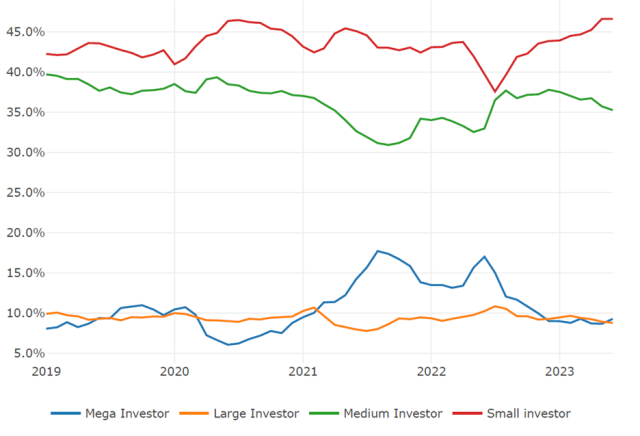

As the total number of investor purchases declines, smaller investors are growing their market share. Figure 3 shows that throughout 2023, mega-investors (those that own 1,000 or more properties) and large investors (those that own 100 to 999 properties) have both held market shares of between 8% and 10% in each month. In the case of mega-investors, this is a drastic decline from the high of 17% of all investor purchases recorded in June 2022. Medium investors (those that own 10 to 99 properties) saw a modest decrease in activity, from 37% to 35%.

Typical housing market investors are becoming more and more likely to operate smaller scale (owning three to nine properties). In June, this group accounted for 47% of investor purchases, the highest level since 2011, according to CoreLogic data.

Throughout Q2 2023, large and mega-investors showed muted activity. In April, May and June, mega-investors each made between 7,000 and 9,000 purchases per month, numbers that are consistent with those recorded before the home investor surge began in 2021.

Small investors made 38,000, 46,000 and 38,000 purchases in April, May and June, respectively. Though these are big drops from 2021 and 2022, they are still above 2019 and 2020 levels. In those years, the April, May, and June numbers were a respective 30,000, 34,000 and 31,000 (2019); and 22,000, 23,000 and 32,000 (2020)

In the second half of 2022, home-flipping activity lagged. Only 12% of investors that purchased a home in December 2022 resold that property by the end of June 2023. This is a lower share than seen in previous years but a slight increase from the 11% recorded three months earlier.

This data point indicates that the decline in home flips may have bottomed out since such transactions are tightly connected to price appreciation, and home prices have slowly recovered in the past few months. The flip rate should rise slightly in the near future.