U.S. Home Investors Poised For Growth

Economic turbulence favors small investors in hurting markets.

From increased regulation and the COVID-19 pandemic to regional banking turmoil and historically low inventory, the past several years have been chaotic for the residential real estate investing community, including the ranks of private lenders who finance this maturing sector of the home purchase market.

Not to be discouraged, some of the nation’s top private lenders gathered recently at Originator Connect in Las Vegas to discuss the health of the industry before a crowd of anxious yet excited mortgage brokers and originators.

“We’re getting positioned, the ability to keep putting capital out . . . I think the outlook, certainly beyond 12-18 months, is really, really good,” said Robert Greenberg, director of lender finance at Lima One Capital.

With the 30-year fixed-rate mortgage reaching its highest level since 2001 this week and National Association of Realtors (NAR) Chief Economist Lawrence Yun claiming at Originator Connect the housing recession has ended, it remains to be seen whether residential investors will be able to maintain their elevated market share if – or when – interest rates drop, and inventory improves.

It’s possible the housing market will deteriorate further before it begins to recover, but the reality is that residential investing isn’t for the faint of heart. For investors and their private lending counterparts, the opportunity is now.

“The environment to me,” Greenberg continued, “feels a lot like it did maybe in 2017 and 2018 when the private money space went really strong.”

Turbulence Favors Small Investors

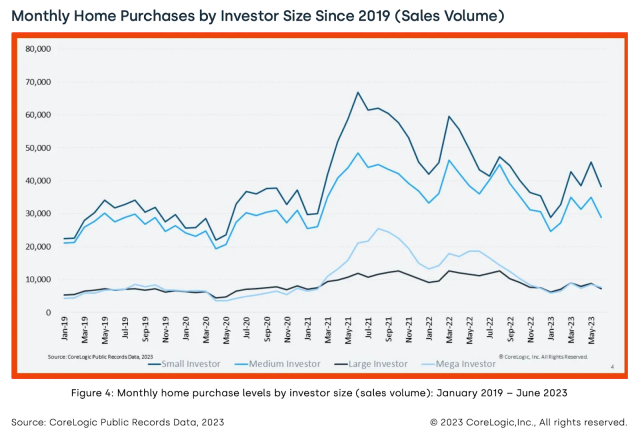

Historically low mortgage rates during the pandemic were a boon to investors purchasing single-family homes. Data collected by CoreLogic, the property information, analytics, and data solutions provider, show U.S. home investor market share jumped from a low of 14% in April 2020 to a peak of 28% in February 2022, at which time the Federal Reserve began its series of aggressive interest rate hikes and investor share declined to 21% by June 2022.

However, home investor market share rebounded last summer and has remained above 25% through the first half of 2023. Data published by CoreLogic last week shows investors accounted for 26% of all single-family home purchases in June, down one percentage point from March.

While this consistency indicates investor involvement in the residential purchase market is poised to remain a significant factor in the near term, another surge in residential market share seems unlikely, says CoreLogic economist and report author Thomas Malone. The last surge occurred in the first half of 2021, coinciding with a surge in home values and very low interest rates. It’s a scenario unlikely to repeat anytime soon, Malone said.

Increased home investor share is partially being driven by investors keeping their activity elevated while owner-occupied (non-investor) activity has significantly dropped – the result of high mortgage rates and low inventory. In fact, increased single-family purchase activity among small investors indicates turbulence in the broader economy has benefited mom-and-pop investors.

“Typical housing market investors are becoming more and more likely to operate at a smaller scale, owning three to nine properties,” Malone said.

CoreLogic’s data shows that small investors (those owning three to nine properties), made 38,000, 46,000, and 38,000 single-family home purchases in April, May, and June of 2023, respectively. Though down from 2021 and 2022, these sales are well above pre-pandemic levels. In April, May, and June of 2019, small investors made single-family home purchases of 30,000, 34,000 and 31,000, respectively.

“Small investors aren’t buying the way they were during 2021, but their activity hasn’t dropped off as much as it has for large and mega-investors,” Malone said.

In June, small investors accounted for 47% of investor purchases, the highest level since 2011, and up from 38% last July. Malone posits that small investors don’t move between asset classes as actively as mega-investors do without a hedge fund or diversified portfolio, explaining why small investors have remained active as mega-investors have pulled back.

The rise of “accidental landlords” – homeowners who buy new homes but, instead of selling their former homes, hold onto the low mortgage rate as a rental – also accounts for the increased market share of small investors.

DSCR Loans: A Golden Ticket

Part of what’s driving the rise of small investors is the growing familiarity among investors and originators with debt service coverage ratio (DSCR) loans.

DSCR loans are business-purpose loans that are popular among real estate investors who require more flexible financing than Fannie Mae and Freddie Mac offer. Business purpose loans don’t fall under the regulatory jurisdiction of the Real Estate Settlement Procedures Act (RESPA) or Consumer Finance Protection Bureau (CFPB).

DSCR loans are the bread-and-butter of private lending due to the ease and speed of the loan approval process. Alan Crummack, a Naples, Fla.-based mortgage broker, makes DSCR loans part of his leave-no-stone-unturned origination strategy, especially during slower markets.

Crummack currently has 15-20 DSCR loans in his pipeline.

DSCR loans are underwritten based on a property’s projected cash flow (rental income), not the borrower’s personal income. Because minimal documentation of the borrower’s personal financial soundness is required to qualify, they’ve been compared to the “no-doc” (documentation) mortgages made infamous during the run-up to the Great Recession.

Yet, associating DSCR loans with the subprime lending crisis is a red herring. Unlike non-investor, owner-occupied properties, properties financed by DSCR loans are appraised on those properties’ likelihood to generate cash flow. From an underwriting perspective, the ability to repay a DSCR loan depends less directly on a borrower’s financial standing and more directly on a property’s vacancy rate.

Crummack targets foreign buyers, especially Canadians, because he sees them as an untapped part of the U.S. home investor market. “No credit check or employment verification makes it easy for foreign buyers. For a lot of snowbirds, it’s cheaper to buy than to rent down here,” he says.

California Dreaming

Nowhere were investors more active last quarter than in California, the housing market that’s hurt the most over the past 18 months.

CoreLogic data reviewed by NMP shows California accounted for 10 of the top 15 core-based statistical areas (CBSAs) where investors made up the greatest percentage of single-family home purchases in April, May, and June. In the CBSA that includes San Jose, Sunnyvale, and Santa Clara, Calif. – the top investor CBSA on CoreLogic’s list – investors accounted for 44.69% of 2,488 single-family home purchases made last quarter. In the second-most popular investor CBSA, which includes Los Angeles, Long Beach, and Anaheim, investors accounted for 41.12% of 13,367 purchases. Small investors accounted for 16% and 14.8% of purchases, respectively.

Malone says the most plausible theory explaining why investors have been more active in California is the relatively high levels of out-migration and home price depreciation that the state has experienced over the past year as interest rates have risen.

“More property available and more desperate sellers, so more buying power for investors,” says Malone. Banking turmoil exacerbated by the failures of Santa Clara-based Signature Valley Bank and San Francisco-based First Republic Bank have made mega-investors more cautious because they're more leveraged across various industries, and their buy-in is much higher. That gave small investors more opportunity to scoop up properties.

As of July, home prices were down in San Francisco more than 14% year over year. The San Francisco-Oakland-Hayward CBSA was sixth on CoreLogic’s list, with investors comprising 35.23% of the single-family home purchase share. Small investors accounted for 14.76% of the single-family home purchases, while mega-investors accounted for just 4.65%.

Keeping Tabs On Investors’ Investments

Yet, while investors may be more focused on cash flow than interest rates, it doesn’t mean they haven’t felt the pain of the Fed’s interest rate hikes. What threatens consumers’ ability to spend and borrow money threatens investors’ ability to operate at a profit, says Bram Gallagher, an economist at AirDNA, a vacation rental analytics firm.

“For investors, rising interest rates make the investment thesis more difficult to achieve. The carrot’s getting smaller and the stick’s getting bigger,” he explains. Part of Gallagher’s job is to analyze data on available short-term rental listings to glean market-level insights on the performance of individual units. “The investors’ investments,” he calls them.

As interest rates have risen, demand (as measured by occupancy rates) has failed to keep pace with supply, leading Gallagher to observe a steady decline in available listings. However, the shrinking gap between supply and demand over the past two months is a positive sign for the short-term rental market.

“The attrition of rentals has definitely diminished this year,” another positive sign Gallagher has noticed. Rental attrition is industry parlance for, in this case, individual listings’ year-to-year survival rate. Improving attrition rates in 2023 is a sign that the short-term rental market is stabilizing. Moreover, though demand has leveled off from 2021 and 2022, it remains above pre-pandemic levels.

“The leveling off being closer to 2022 levels signals a permanent shift to a higher occupancy level than we saw pre-pandemic,” Gallagher projects. Like any good economist, he hedges that various economic events could impact occupancy rates through the end of the year.

Those that erode consumers’ disposable income erode occupancy rates and investors’ profits. They include rising unemployment, a Fed decision to leave interest rates elevated, and, to a degree, the resumption of student loan payments.

“So would a recession,” Gallagher says. “I don’t think people would stop their vacations, but they would trade down for places that are closer or less expensive, especially average consumers.”