U.S. Home Prices Surge 4.5% YoY

CoreLogic's Home Price Index reveals robust growth of 4.5% in September; Northeast leads the surge.

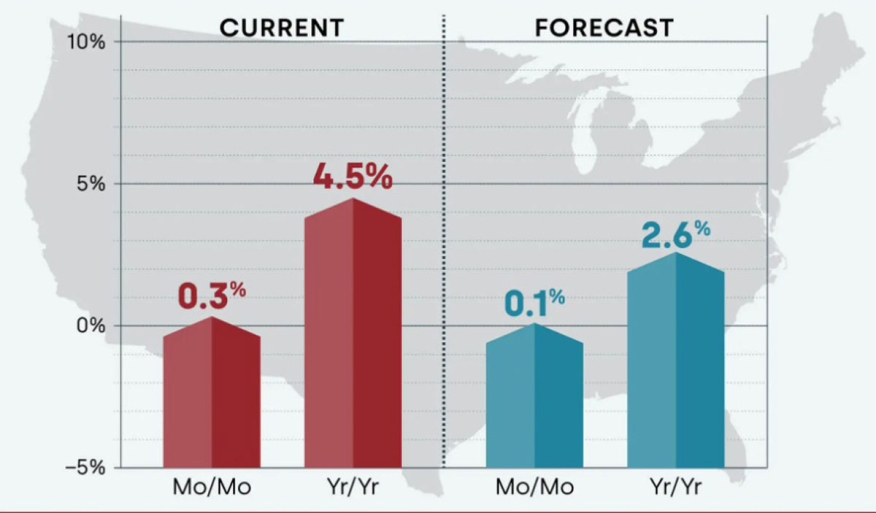

As mortgage rates climbed in September, so did home prices, according to CoreLogic's recent Home Price Index (HPI) report. The report found U.S. home prices recorded a 4.5% year-over-year increase in September. This gain marks the largest since February and suggests ongoing resilience in the housing market.

The Northeastern part of the country experienced the most significant price appreciation. Maine led the way with a remarkable 10.1% annual increase, representing the first double-digit HPI gain recorded in any state since early 2023. Other states with higher price increases included Connecticut at 9.5% and New Jersey at 9.2%.

Despite the rise in mortgage rates, which are now approaching 8%, coupled with inventory challenges, the robust U.S. job market is expected to keep price growth moderate and steady over the next year.

"While annual home price growth continued its third month of upward momentum in September, this mostly reflects a comparison with last year’s lows, when prices began to cool from double-digit growth in autumn 2022," CoreLogic's Chief Economist Selma Hepp said. "Still, given the continued rise of borrowing costs in 2023, it is remarkable to see how resilient home price growth has been in recent months, with September’s 0.3% month-over-month gain lining up with pre-pandemic trends. Nevertheless, as mortgage rates significantly impact affordability, certain markets with continued in-migration from more expensive states are showing renewed buoyancy and outsized monthly price gains.”

A&D Mortgage CEO Max Slyusarchuk said educating borrowers about what's happening in the market is important.

"The resilience of home price growth, especially in the Northeast, is a testament to the enduring demand and the fundamental economic principles supporting the market," Slyusarchuk said. "Maine's remarkable 10.1% annual increase underscores the significant regional disparities that we, as mortgage professionals, must account for in our client consultations. It’s not just about understanding the national trend, but interpreting how localized factors will affect home buying patterns and mortgage affordability."

He said the report suggests that growth will moderate next year with a projected increase of 2.6%. That "suggests that home prices are not in a free fall but adjusting to a new equilibrium," Slyusarchuk added.

The regions with a high probability of seeing a price decline soon, according to CoreLogic, are Youngstown-Warren-Boardman, OH-PA; Cape Coral-Fort Myers, FL; Spokane-Spokane Valley, WA; West Palm Beach-Boca Raton-Delray Beach, FL and Deltona-Daytona Beach-Ormond Beach, FL.