U.S. Homeowners Grapple with Rising Financial Anxiety, Survey Reveals

While economic and personal financial concerns intensify, many overlook vast home equity potential as a financial cushion.

Nearly 8 out of 10 homeowners feel anxious about the state of the U.S. economy, the same as 2022, while anxiety about financial expenses increased further. That's according to a new survey by Finance of America Reverse LLC (FAR).

The survey gauges homeowners' sentiment on home equity, long-term financial planning, and perceptions of the U.S. economy.

Concerns about personal financial expenses are intensifying. Homeowners increasingly worry about unexpected healthcare costs in retirement (61%, up from 48% in 2022) and their ability to manage debt (40%, up from 36%). Anxious feelings also surround discretionary expenses like buying a car or traveling, with 41% feeling this way, a climb from 32% in 2022.

A deeper dive into the data reveals gender and generational patterns. Women show greater concern about long-term financial stability, with 82% anxious about the economy, compared to 75% of men. Younger generations, specifically Gen Z and millennials, express heightened anxiety about the economy, their retirement ability, and handling unexpected medical costs.

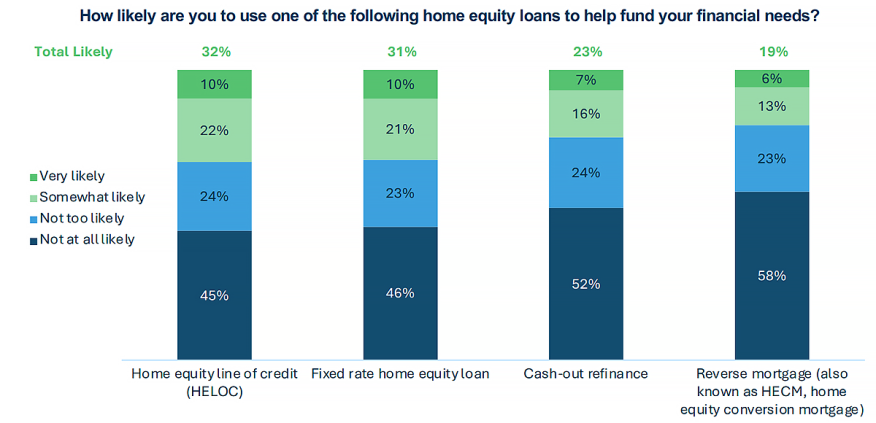

However, despite these financial fears, homeowners appear hesitant to tap into their housing wealth. The study shows only a modest rise in homeowners considering home equity loans, from 28% in 2022 to 32% in 2023.

“More than three in four seniors can’t meet their financial obligations in retirement, and America’s retirement savings gap approaches a staggering $4 trillion," Finance of America Chief Marketing Officer Chris Moschner said. "There is a persistent lack of education and limited understanding of the benefits of home equity-based solutions and reverse mortgages.”

He said the enormous $12 trillion in home equity amassed by seniors 62 and older represents a golden opportunity to bolster financial security.

The survey further exposes a pervasive unfamiliarity with various financial tools, especially among women and baby boomers. In this context, the study pinpoints a distinct knowledge gap about how home equity and reverse mortgages can mitigate common financial challenges.

Steve Resch, vice president of retirement strategies at FAR, expressed optimism about the potential of home equity-centered financial solutions. He underscored the need for robust education initiatives for homeowners and financial advisors to bridge the existing knowledge divide.

“We are well-positioned to help retirees live more comfortably and thrive in retirement; yet that requires greater education and collaboration among homeowners and financial advisors alike to help narrow the familiarity gap," Resch said.