For Lenders, It’s a Wake-Up Call

Until now, mortgage technology companies have been worried about lender pain points instead of the customers. The fact that the customer experience and complaints haven't changed much in 20 years is evidence of mortgage technology being focused in the wrong place.

Lenders should be more concerned with delighting their customers with an ideal mobile experience. Steve Jobs said it best when he said that new customer experiences change markets—that’s why he helmed the most valuable company in the world; one that sold a complex product so easy to use it didn’t come with a user manual.

In view of rising mortgage rates, lenders need two things to win the future: an Uber-like customer experience and low rates. Mobile is the only enabler of a new mortgage experience, and Web3 automation drives the ability to lower acquisition costs and offer lower rates. And considering where rates are headed, buyers will be ultra-rate conscious for the foreseeable future.

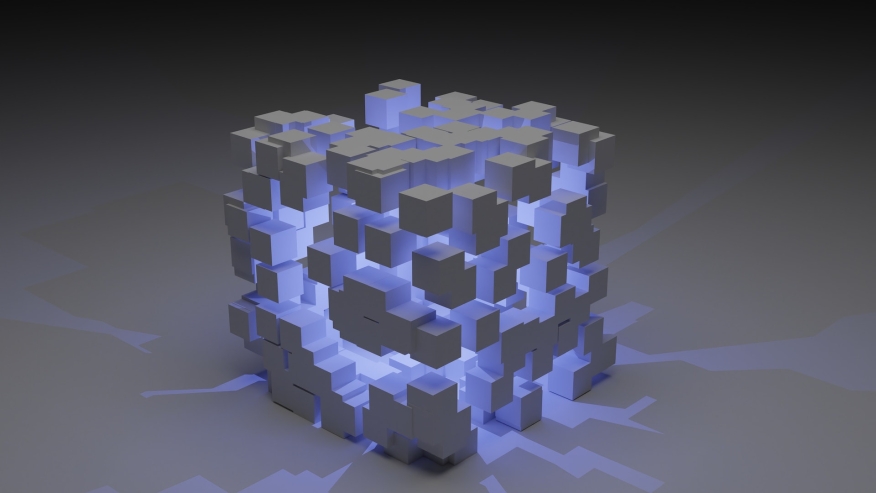

With this in mind, it’s clear that we’re at an inflection point—some will fail while others scale, and those who leverage Web3 mobile will have staying power for decades–unlike most “digital” lenders today. After all, digital doesn’t equal a mobile mortgage experience.

Looking ahead, advanced LOS automation enhanced with Web3 is already speeding up these processes–and with startling accuracy. It’s as if AI is the brain of a very smart robot, and a smart contract is the decision-making mechanism–the second key component for solid, reliable loan approvals.

The Wrong Kind of Digital Mortgage

And so, you may ask, why isn’t the AI/blockchain combo everywhere?

So far, the problem has been this: Attempting to redesign and repurpose the latest mortgage tech for today's mobile consumer is a lot like turning the Titanic or trying to turn a battleship into a speedboat. It’s easier to start from scratch by rethinking the entire thing.

For the past 20 years, some technology companies have been trying to figure out how to automate loan origination, but the one thing they’ve never moved away from is the trust component placed on that human loan officer, along with the process dependency on the processor. It’s a point of contention with many banks.

The fear is that a lack of human review will increase the inherent risk one engages in when lending—i.e., if you disposition a file incorrectly or render an inaccurate decision of credit, there’s liability. Nobody wants to get stuck in an agreement that they don’t actually agree with, not to mention the monetary aspect of some mistakes.

Ironically, the surest way you can actually lower that risk is to employ a smart contract at precise moments in the lifecycle of data that handle critical qualifying information that impact pricing. Blockchain has no human biases, no data misreads, and is fully encrypted before it’s ever executed. In fact, the blockchain itself doesn’t know what it’s looking at, as it’s buried in the strictest bank-level encryption.

Despite all the checks a file goes through prior to closing, human error is still the #1 cause of defects, cures, buybacks, and lender liability. This is where blockchain is different: you can trust it. Humans make mistakes, but in code we trust.

Silicon Valley has a lot of smart software engineers with a lot of funding, but the question has to be asked, why hasn’t the industry been impacted with an Uber-like moment yet?

The reason is two-fold: 1) Lender resistance to major change, which impacts the second reason, 2) Mortgage technology companies making software they can sell. This software is not innovative, which is what the industry and borrowers desperately need. This is also why the industry hasn’t been truly disrupted by mobile.

These brilliant engineers operate with the fear that they can’t be too different or else the lenders won’t use them. Even worse, they don’t intimately understand either the mortgage process or the borrower. They have no vision for changing the industry—they just want to alleviate aspects of the journey in order to make as much money as possible as quickly as possible for their VC backers.