Zillow: Bidding Wars To Persist For Entry-Level Home Shoppers

Analysis finds rising prices for entry-level homes, coupled with low inventory, fan fierce competition.

- Prices for the least-expensive one-third of houses rose 8% nationally over the past year.

- Prices for top price-tier homes fall for the first time since 2012.

- Only 1% more homes are available for entry-level shoppers.

Face shields, shin guards and a change of clothes remain required gear for entry-level home shoppers this spring, a Zillow analysis suggests.

With national housing inventories low and prices for the least-expensive one-third of houses continuing to rise, entry-level buyers should anticipate bidding wars — and embrace the pain of paying over list.

"Buyers shopping for the least-expensive homes this spring aren't noticing much difference from the pandemic-era market heat," said Skylar Olsen, Zillow's chief economist, referencing the analysis that examines year-to-year changes in typical home values and new listings.

According to Zillow, prices for bottom tier-priced homes are up 8% nationally over the past year. Middle tier-priced homes have risen 3%, while top price-tier homes fell 1% — the first price drop for America’s most-expensive homes since 2012.

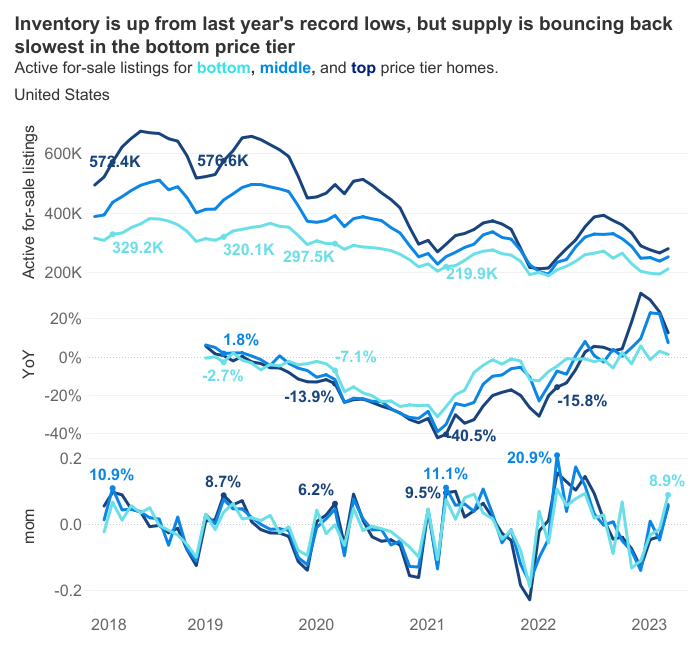

Adding insult to injury for entry-level shoppers, high mortgage rates continue to throttle the flow of new listings across price tiers. Though housing inventory has risen since last year’s record lows, homes in the bottom price tier have been slowest to return. Only 1% more homes are available for entry-level shoppers, compared to an 8% and 13% rise in the middle and top tiers, respectively.

In the entry-level market, upward pressure on prices is expected to persist as long as inventory remains low, Zillow said.

The combination of rising interest rates, rising home prices, and low inventory levels translates to a significant drop in purchasing power for all prospective buyers, but entry-level shoppers tend to feel this pain the most, the analysis said.

With the 30-year fixed-rate mortgages over 6%, rate lock has slowed the sales of middle and top tier-priced homes. With 17% of homes across price tiers selling above list as of February, many entry-level shoppers who lack the financial reserves of buyers in mid- to upper-price tiers find themselves unable to enter the market at all.

Those intent on buying will likely find themselves in bidding wars against shoppers who can more easily afford homes at the lower-priced end of the market, Zillow said.