Zillow Focused On The Future As It Reports Q4, Year-End Losses

CEO says Zillow 'on solid ground' despite year-end loss of $101M.

- Zillow reported a net loss of $72 million in the fourth quarter of 2022, vs. a net loss of $53 million a year earlier.

- Revenues in the quarter were $435 million, topping analyst expectations of $413 million.

Given how unflattering the present is, it’s no surprise that executives at Zillow Group Inc. have their eyes on the future.

Zillow, the Seattle-based digital real estate company, on Wednesday reported a consolidated net loss of $72 million, or 21 cents per diluted share, for the fourth quarter of 2022, compared with a net loss of $53 million in the third quarter.

For the full year, Zillow reported a net loss of $101 million, or 36 cents per diluted share, an improvement over the net loss of $528 million, or 39 cents per diluted share, a year earlier.

The fourth-quarter loss came on total revenue of $435 million, which beat analyst estimates of $413 million. For the full year, revenue was just $1.96 billion, just below the $2.1 billion in revenue a year earlier.

“While navigating a slow and difficult housing market in 2022, we kept our eyes on the future — our vision of building the housing super app,” Zillow co-founder and CEO Rich Barton said. “Our consolidated Q4 financial results outperformed our expectations, and we’ve been rapidly shipping products aligned with our five growth pillars. We’re building momentum that will help us scale as we serve customers and the industry with an easier, more seamless way to transact in real estate.”

During a conference call with analysts and the media Wednesday evening, Barton described 2022 as “an extraordinarily difficult and transformative year for Zillow.”

“We began 2022 with 10,000 homes on our balance sheet and ended with zero,” he said, referring to the closing of Zillow Offers, its iBuying business. The company shuttered Zillow Offers in the third quarter of 2021, and cleared its books of its housing inventory by the middle of 2022.

“Unfortunately,” Barton said, “this also necessitated a workforce reduction of approximately 2,000 valued employees.” He said the company’s employee base is now “in a far more stable place” than it was at the start of the year.

In addition, he noted, despite quickly shedding its iBuying inventory, “the unprecedented housing macro volatility continued,” this time with 30-year mortgage rates nearly doubling over the course of the first six months of 2022.

Still, he said the company was on “solid ground heading into 2023. Our traffic and brand are extremely strong, with average monthly unique users of 198 million during Q4, and roughly 65% of mobile app users for the real estate marketplaces category.”

Also during 2022, he noted, Zillow regained its spot as the No. 1 most-visited rentals platform, according to comScore, “putting us in a great position for future growth.”

As for the rest of 2023, Barton said Zillow is focused on its vision of building a “housing super app, a single digital experience to help customers across all their real estate needs.”

He continued, “Our goal is to increase engagement, increase customer transactions and increase revenue per transaction by investing across five growth pillars: touring, financing, seller solutions, enhancing our partner network, and integrating our services. The expected output of this strategy is to grow our share of consumer transactions from 3% to 6% by the end of 2025.”

Barton said Zillow spent much of 2022 creating products and services for those five pillars, and is ready to test them in certain markets, including Raleigh, N.C.; Denver; Atlanta, and Phoenix.

Key highlights of Zillow’s earnings report:

- Premier Agent revenue outperformed the company’s expectations and the industry total transaction dollar decline of 31%, decreasing 20% year over year to $283 million for Q4.

- Rentals revenue increased 13% year over year to $68 million as the company continued to see strong traffic and growth in multifamily properties.

- Its mortgages segment revenue was $18 million for Q4, near the midpoint of the company’s outlook range.

- During Q4, the company acquired VRX Media, a national photographer network, which helped accelerate the launch of Listing Media Services through the ShowingTime+ brand in early Q1 2023. The company also this week launched a new selling solution with Opendoor that enables homeowners to explore multiple selling options on Zillow.

- Cash and investments at the end of Q4 were $3.4 billion, compared to $3.5 billion at the end of Q3 2022, after $174 million in share repurchases during the quarter. As of the end of Q4, $500 million remained under the company’s total repurchase authorizations of $1.8 billion. Convertible debt outstanding was $1.7 billion at the end of Q4.

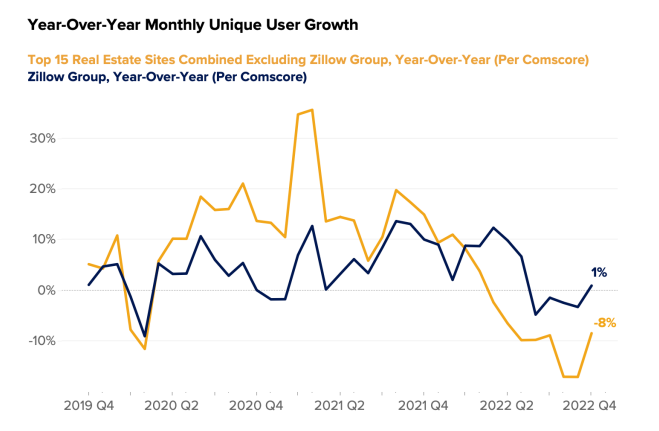

- Traffic to Zillow Group’s mobile apps and websites in Q4 was 198 million average monthly unique users, flat year over year. Visits during Q4 were 2.2 billion, down 5% year over year. Average monthly unique users for 2022 were 220 million, up 1% year over year. Visits during 2022 were 10.5 billion, up 3% from the previous year.