Zillow Offers Look At Typical Home Seller

2022 Consumer Housing Trends Report provides a glimpse into sellers' behaviors.

- The study, conducted between March & June 2022, found the typical U.S. seller is 46 years old.

- Of the dual seler-buyers, 4% upgraded to buying a more expensive home than the one they sold, a sharp drop from 2021's 55%.

- Sellers who included a virtual tour in their home listing were more likely to report receiving at least 1 all-cash offer vs. sellers without a virtual tour.

The typical U.S. home seller is white, 46 years old, has household income in the low $80,000 range, and is also buying a home.

That's the general findings from Zillow's 2022 Consumer Housing Trends Report, released Tuesday. The report includes three nationally representative surveys of more than 5,900 unique sellers, conducted between March and June 2022.

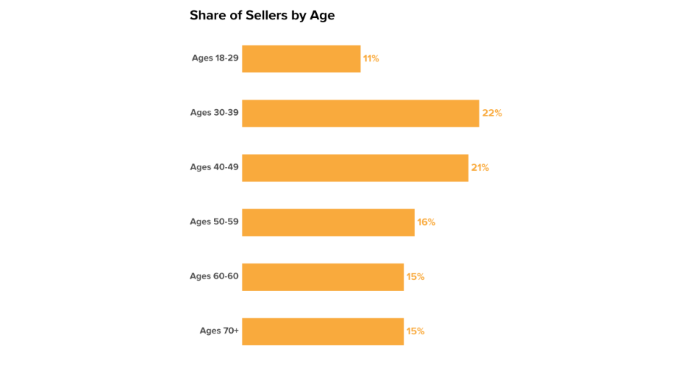

Zillow found that the typical U.S. seller is 46 years old, and that about 12% of sellers are in their 20s or younger. The report’s data broadly showed that most sellers are partnered, married, or previously married, have at least some college education, and are most likely to sell a home in the South.

About seven in 10 sellers reported buying a home in addition to selling one; 44% of these dual seller-buyers upgraded to a more expensive home than the one they sold. This represents a drop from 2021, when 55% of dual seller-buyers purchased a more expensive home.

Three quarters of sellers are non-Hispanic white or Caucasian, which is higher than the overall share of the U.S. adult population that is white (63%).

The annual median household income among sellers is approximately $80,000 to $84,999, higher than the overall national median in 2021 of $65,700. In addition, 45% of sellers have at least a four-year degree, which is higher than 34% of decision-makers.

Consistent with the past four years, the typical seller received two offers, but a notable share reported receiving more than that. Almost a quarter of sellers reported getting at least four offers, continuing the upward trend from 14% in 2020. Since 2019, the share of sellers that report selling without any offers (sellers who forgo the traditional selling process, often selling to friends or family) fell 11 points from 14% in 2019 to 3% in 2022.

Meanwhile, 57% of sellers said they received at least one offer that waived an inspection. However, 88% of successful buyers said they got an inspection before finalizing their home purchase. A similar share of sellers (84%) reported that a potential buyer completed an inspection on the home at least once.

Despite the rise of digital options like remote viewings, 3D tours, and instant offers, Zillow found that sellers’ use of a real estate agent has remained high over the last three years. The typical seller still holds only one open house, but the share that forgo an open house entirely fell in the past year: 33% said they had none in 2022, compared to 43% in 2021. Two-thirds of sellers reported they never take their home off the market until it is sold.

Other key takeaways:

- Almost all sellers (92%) indicated some kind of agent use. About 73% said they hired an agent to help promote their home and find potential buyers.

- Sellers who included a virtual tour in their home listing were more likely to report receiving at least one all-cash offer (70%) than sellers who did not include a virtual tour (56%), and they typically sold for 22% more.

- Most sellers (71%) said they completed at least one improvement project as part of selling their home, such as painting, redecorating, kitchen improvement, new appliances, or replacing/repairing flooring.