Zillow: Spring Housing Market Will Be Calm, But Competitive

Easing mortgage rates bringing buyers back, but don't expect the fervor of recent years.

The spring shopping season should be competitive, but quiet.

That’s the opinion Zillow presents in its latest analysis of the housing market.

According to the digital real estate company, homeowners are largely staying put, so attractive listings will see strong interest. For both buyers and sellers, affordability remains the biggest challenge, with everyone keeping a close eye on mortgage rates.

Shoppers can expect competition for well-priced homes, Zillow said, but without the frenzy of numerous buyers that packed open houses like they did in 2021 and early 2022.

"Affordability will still be a challenge for many buyers this year, but sellers who price and market their home competitively shouldn't have a problem finding a buyer," said Jeff Tucker, Zillow’s senior economist. "The slight drop in mortgage costs since October should revive demand after last fall's slump, especially in more affordable markets and neighborhoods, but we are unlikely to see competition approach the fever pitch seen in the last two years."

Sales still slow

The market cooled dramatically in the second half of 2022, following two straight years of white hot competition, thanks mostly to rising mortgage rates. But as mortgage costs slipiped back from their peak in the fall, home sales returned.

Zillow said sales remain below where they were a year ago, but have rebounded significantly over the past few months.

Today, buyers typically spend about 31% of their household income on a mortgage — $1,595 a month — after a 20% down payment, Zillow said. That's $170 a month below the 34% of income required in October, but well above the 20%–22% they spent in the 10 years before the pandemic — the monthly cost of principal and interest was less than $900 in January 2019.

But even as affordability affects the share of households looking to buy, demographics are contributing to demand through sheer numbers, Zillow said.

The company said its 2022 national consumer survey found the median age of the first-time home buyer was 35 years old. The youngest members of the millennial generation are now entering their late 20s, the oldest are approaching their mid-40s, and the bulk will soon be hitting prime first-time home-buying milestones, it said.

Spring outlook

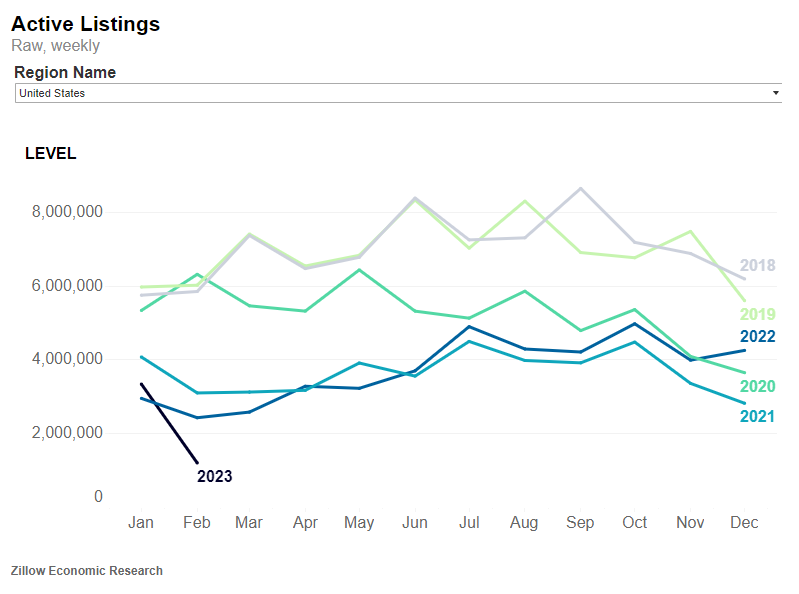

There are as few homes for sale to start the year as there were in 2021, which was a record for scarcity at the time, Zillow said. But the market has cooled significantly from early 2021 and 2022, when ultralow mortgage rates triggered bidding wars over most listings.

Buyers should expect competition — especially in more affordable markets like Cincinnati and St. Louis — and at lower price points, Zillow said. Buyers will mostly be motivated by the life transitions that have always triggered home purchases — new jobs, marriages and births — and less by the deal of a lifetime on mortgage rates, it said.

For sellers, well-priced, well-marketed homes will receive attractive offers during their first weekend on the market, but many listings will take longer and likely will need price cuts to sell, Zillow said. Last month, 22% of listings saw a price cut, more than any January since at least 2018, it said.

In addition, home prices are forecast to move up slowly, as they have historically, and inch a little higher this spring after seasonal winter lows.

Inflation, unemployment and especially mortgage rates will determine what comes next for the housing market, Zillow added.

Mortgage rates will continue to significantly affect both supply and demand. If rates move lower, toward 6% or below, they will bring more buyers to the market and make it more palatable for homeowners to sell, increasing supply, Zillow said. If rates rise to the upper 6% range or above, it will likely deter buyers, it said.

"The housing turnaround since November has coincided with what are typically the weakest three months of the year — forecasting the future off that can be dicey," Tucker said. "The economic news from earlier this winter raised hopes for a soft landing of the economy and housing market, but the risk of renewed inflation or even a recession is still significant, and either would have a serious impact on the housing market."