Zillow Survey Reveals Growing Number Of Homeowners Eager To Sell, Easing 'Rate Lock' Concerns

Increasing homeowner willingness to sell, regardless of mortgage rates, coupled with improving affordability signals a potential shift in the housing market dynamics for 2024.

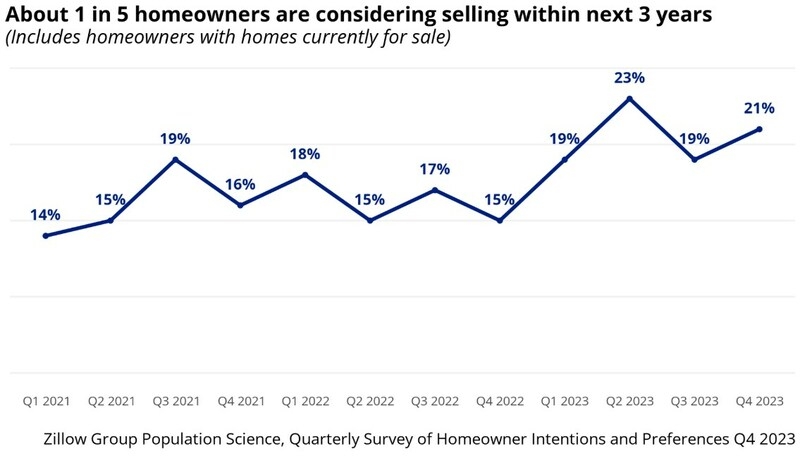

A recent Zillow survey found that 21% of homeowners are contemplating selling their homes within the next three years, a rise from 15% a year earlier.

Conducted in Q4 of 2023, the survey also found an interesting trend: the willingness to sell was almost equal among homeowners with mortgage rates above or below 5%. This marks a considerable shift from six months ago, indicating that current mortgage rates are becoming less pivotal in homeowners' decisions to sell.

"Buyers found significant savings as rates fell. But mortgage rates are fickle things, as we've seen in recent weeks, and they'll play a massive role in determining appreciation and affordability — especially for first-time buyers — going forward in 2024," Zillow Chief Economist Skylar Olsen said. "Fortunately, rate lock appears to be wearing off for some homeowners, who show encouraging signs that they're ready to come back to the market."

The report also brings good news on the affordability front. The monthly payments for a new mortgage on a typical home have decreased to $1,790, $143 less than in October. This reduction has restored some level of affordability to home buying, with a new mortgage now requiring less than 33% of the median household income. However, this is a national average, and in many expensive metros, the median household remains priced out of the market. Furthermore, the requirement of a 20% down payment remains a significant hurdle, particularly for first-time buyers.

As for inventory, there's steady progress in recovery from pandemic-induced lows. Annual inventory gains were recorded for the first time since April, although levels are still 36% below pre-pandemic averages. The flow of new listings shows slight improvement, pointing to a cautiously optimistic outlook for 2024.

Despite these positive trends, buyers should brace for ongoing competition. With limited options, price cuts are rare, and attractive listings are likely to draw intense interest. Zillow's data highlights that nearly 30% of homes are selling above their original list price, a significant increase from the pre-pandemic years.