Advertisement

Mortgage Economic Review: June 2019

Angst on Wall Street soared in May, as tensions with China and Mexico heated up. Trade negotiations between China and the US broke off suddenly—which rattled the markets and sent stock prices on a roller coaster all month. In addition, President Trump threatened new tariffs against Mexico due to the migrant situation at the border. The one big sticking point was Chinese espionage, specifically the Chinese telecom manufacturer Huawei (pronounced Wah-Way). The U.S. placed severe restrictions against Huawei, making it almost impossible for the company to sell its products in the US. If a full-blown Trade War develops, let's not forget that China is holding US debt to the tune of $1.12 trillion - which they can use to retaliate in a Trade War. However, China can't hurt the US too much - the reality is that to stay Economically healthy, China needs US Consumers to buy their products. This month's Mortgage Economic Review summarizes Key Economic Data that is important to Mortgage and Real Estate Professionals.

Key Economic Data and Events in May 2019

Interest Rates and Fed Watch

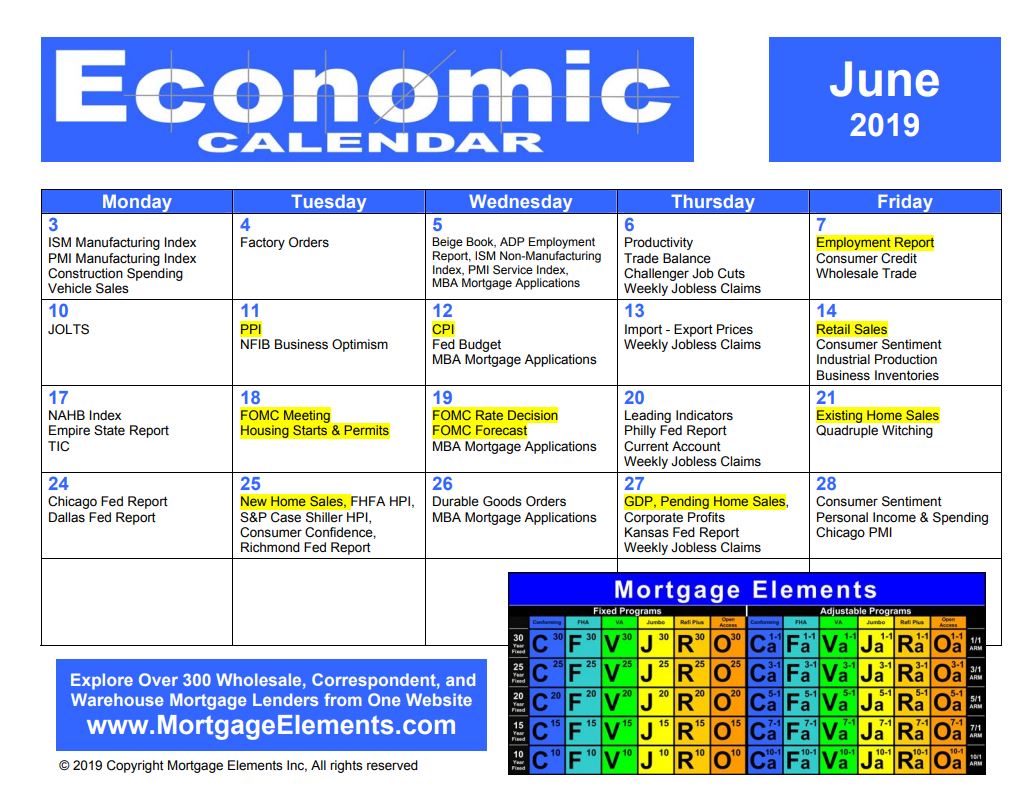

The last FOMC Meeting concluded on May 1st with the FOMC Minutes released on May 22nd. Reading the Minutes, you get the impression that most Fed Governors are in favor of keeping Interest Rates steady. The Fed has remained non-committal as to their next move, but they have reiterated they will be "patient" and "data dependent". Fed Speak translation: they are in no hurry to raise or lower Interest Rates anytime soon as they sit back and watch the Economic Data roll in. That means they are watching Inflation and the all-important yield curve - which is close to inverting. They are also monitoring trade tensions, Stock Market volatility, oil prices, and European Economic stability. The next FOMC Meeting starts June 18th and Fed Watchers don't expect any changes in Interest Rates - but odds of an Interest Rate cut before year end have increased and are now at 85%.

222 Fed Target

Housing Market Data Released in May 2019

Another month of mixed Economic Data from the Housing Market. With Interest Rates lower and a strong Labor Market, the Housing Market should be having a great spring buying season - but it's just ok. Most Loan Officers I've talked to say they are busy with both Refi and Purchase transactions. Plus, they are seeing an increase in 1st Time Buyers. The dip in Interest Rates and softening of home prices has helped affordability, so the typical spring buying season may very well extend into the summer and fall. If rates keep dropping, we could see a busy Purchase and Refi market all year.

Labor Market Economic Data Released in May 2019

The Labor Market continues its robust pace. The Bureau of Labor Statistics reported the Economy added 263,000 new jobs during April (190,000 expected). For the last 3 months, the Economy added an average of 170,000 new jobs each month. Unemployment dropped to 3.6% - the lowest rate in 50 years and there are now an estimated 750,000 to 1,000,000 job openings that are unfilled. Where were the new jobs created? 4,000 were in manufacturing, 33,000 in construction, 76,000 in business services, 76,000 in education / health, 34,000 in hospitality, 11,000 in transportation, 27,000 in government. Retail lost 12,000 jobs - skip down to the Consumer section and read about store closings.

Inflation Economic Data Released in May 2019

Another month of Inflation data coming in lower than expected. Inflation rose slightly in April due to higher prices for gasoline, shelter and health care. Shelter costs, which comprise a third of the CPI, rose 0.4% (3.4%YoY), energy costs up 5.4% (2.9% YoY) and health care up 0.3% (2.3% YoY). Clothing prices have been rapidly declining for the last few months. They dipped 0.8% this month after falling 1.9% the prior month. New Car prices rose 0.1% while Used Car prices declined 1.3% - the third straight month of price decline for Used Cars. Inflation has been modest considering this is the tightest Labor Market in 50 years. The Fed considers this recent lull in Inflation as "transitory", and expects it to increase in the future. Sooner or later, higher wages will translate into higher Inflation, but it doesn't look like that will happen any time soon.

GDP Economic Data Released in May 2019

The second estimate of 1st Quarter 2019 GDP showed the Economy expanded at a 3.1% annual rate (3.0% expected). That was a slight revision down from the first estimate of 3.2% last month. The Economy continues to chug along especially when you consider the 1st Quarter typically has slower growth due to cold weather in much of the country. 1st Quarter GDP data reflects growth in Consumer spending, state and local government spending, exports, inventories, and commercial building, while Federal government spending, business equipment, and residential building decreased.

Consumer Economic Data Released in May 2019

Retail Sales data remains weak in 2019 as Consumers continue to pinch their pennies. Consumers cut back on buying cars, electronics, and apparel. Gasoline Sales was up, but that was due to higher gas prices. This is not good news for retailers who are already hurting from online competition. So far this year over 7,000 store closures have been announced, and that's after 5,500 store closures in 2018. Speaking of online sales - they were down too. With such a strong Labor Market and Unemployment at a 50 year low - you would expect Consumers to be spending more on goods and homes.

Energy, International, and things you may have missed

Key Economic Data and Events in May 2019

►Trade negotiations with China were suspended due to the Chinese reneging on key promises.

►Volatility dominated the Stock Market as rattled investors worried over an escalating Trade War.

►FHFA Director Mark Calabria reiterated his desire to end Conservatorship of Fannie and Freddie.

►Uber launched its IPO at $45 with the stock trading as low as $36 - now about $40/share.

►The second estimate of 1Q2019 GDP clocked in at a 3.1% annualized growth rate - 3.2% YoY.

►Inflation remains moderate with the latest CPI at 2.0% YoY.

►Volatility dominated the Stock Market as rattled investors worried over an escalating Trade War.

►FHFA Director Mark Calabria reiterated his desire to end Conservatorship of Fannie and Freddie.

►Uber launched its IPO at $45 with the stock trading as low as $36 - now about $40/share.

►The second estimate of 1Q2019 GDP clocked in at a 3.1% annualized growth rate - 3.2% YoY.

►Inflation remains moderate with the latest CPI at 2.0% YoY.

Interest Rates and Fed Watch

The last FOMC Meeting concluded on May 1st with the FOMC Minutes released on May 22nd. Reading the Minutes, you get the impression that most Fed Governors are in favor of keeping Interest Rates steady. The Fed has remained non-committal as to their next move, but they have reiterated they will be "patient" and "data dependent". Fed Speak translation: they are in no hurry to raise or lower Interest Rates anytime soon as they sit back and watch the Economic Data roll in. That means they are watching Inflation and the all-important yield curve - which is close to inverting. They are also monitoring trade tensions, Stock Market volatility, oil prices, and European Economic stability. The next FOMC Meeting starts June 18th and Fed Watchers don't expect any changes in Interest Rates - but odds of an Interest Rate cut before year end have increased and are now at 85%.

222 Fed Target

►Inflation: 2.0% CPI for the last 12 months

►Wage Growth: 3.2 % for the last 12 months

►GDP Growth: 3.2% annualized rate for the last 12 months

►Wage Growth: 3.2 % for the last 12 months

►GDP Growth: 3.2% annualized rate for the last 12 months

Housing Market Data Released in May 2019

Another month of mixed Economic Data from the Housing Market. With Interest Rates lower and a strong Labor Market, the Housing Market should be having a great spring buying season - but it's just ok. Most Loan Officers I've talked to say they are busy with both Refi and Purchase transactions. Plus, they are seeing an increase in 1st Time Buyers. The dip in Interest Rates and softening of home prices has helped affordability, so the typical spring buying season may very well extend into the summer and fall. If rates keep dropping, we could see a busy Purchase and Refi market all year.

Existing Home Sales (closed deals in April) fell 0.4% to an annual rate of 5,190,000 homes, now down 4.4% in the last 12 months. The median price for all types of homes is now $267,300 - up 3.6% from a year ago. The median Single Family Home price is $269,300 and $251,000 for a condo. First Time Buyers were 32%, Investors 16%, Cash Buyers 20%. Homes were on the market an average of 24 days, and 53% were on the market for less than a month. Currently, 1,830,000 homes are for sale, up from 1,800,000 a year ago.

New Home Sales (signed contracts in April) fell 6.9% to a seasonally adjusted annual rate of 673,000 homes. The median New Home price was $342,200 and the average New Home price was $393,700. The number of New Homes for sale is estimated at 332,000 units which represents a 5.9 month supply.

Pending Home Sales Index (signed contracts in April) fell 1.5% to 104.3 from 105.9 the prior month.

Housing Starts (excavation began in April) rose 5.7% to a seasonally adjusted annual rate of 1,235,000 units - down 2.5% YoY. Single Family Housing Starts rose 6.2% to an annual pace of 854,000 units - down 4.3% YoY.

Building Permits (issued in April) rose 0.6% to an annual adjusted rate of 1,296,000 - down 5.0% YoY. Single Family permits fell 4.2% to 782,000 units - down 9.4% YoY.

Housing Completions (completed in April) fell 1.4% to an annual rate of 1,312,000 units - up 5.5% in the last 12 months. Single Family Completions were down 4.1% to 918,000 units - up 16.6% YoY.

S&P/Case-Shiller 20 City Composite Home Price Index rose 0.1% in March - up 2.7% YoY.

FHFA Home Price Index rose 0.1% in March, now up 4.9% YoY.

Labor Market Economic Data Released in May 2019

The Labor Market continues its robust pace. The Bureau of Labor Statistics reported the Economy added 263,000 new jobs during April (190,000 expected). For the last 3 months, the Economy added an average of 170,000 new jobs each month. Unemployment dropped to 3.6% - the lowest rate in 50 years and there are now an estimated 750,000 to 1,000,000 job openings that are unfilled. Where were the new jobs created? 4,000 were in manufacturing, 33,000 in construction, 76,000 in business services, 76,000 in education / health, 34,000 in hospitality, 11,000 in transportation, 27,000 in government. Retail lost 12,000 jobs - skip down to the Consumer section and read about store closings.

The Economy added 263,000 new jobs in April.

The Unemployment Rate fell to 3.6% from 3.8% the prior month.

The Labor Force Participation Rate fell to 62.8% from 63.0% the prior month.

The Average Hourly Wage rose 0.2% in April and 3.2% YoY.

Inflation Economic Data Released in May 2019

Another month of Inflation data coming in lower than expected. Inflation rose slightly in April due to higher prices for gasoline, shelter and health care. Shelter costs, which comprise a third of the CPI, rose 0.4% (3.4%YoY), energy costs up 5.4% (2.9% YoY) and health care up 0.3% (2.3% YoY). Clothing prices have been rapidly declining for the last few months. They dipped 0.8% this month after falling 1.9% the prior month. New Car prices rose 0.1% while Used Car prices declined 1.3% - the third straight month of price decline for Used Cars. Inflation has been modest considering this is the tightest Labor Market in 50 years. The Fed considers this recent lull in Inflation as "transitory", and expects it to increase in the future. Sooner or later, higher wages will translate into higher Inflation, but it doesn't look like that will happen any time soon.

CPI rose 0.3%, now up 2.0% in the last 12 months.

Core CPI (ex-food & energy) rose 0.14%, now up only 2.1% in the last 12 months.

PPI rose 0.2%, now up 2.2% in the last 12 months.

Core PPI (ex-food & energy) rose 0.1%, up 2.4% in the last 12 months.

GDP Economic Data Released in May 2019

The second estimate of 1st Quarter 2019 GDP showed the Economy expanded at a 3.1% annual rate (3.0% expected). That was a slight revision down from the first estimate of 3.2% last month. The Economy continues to chug along especially when you consider the 1st Quarter typically has slower growth due to cold weather in much of the country. 1st Quarter GDP data reflects growth in Consumer spending, state and local government spending, exports, inventories, and commercial building, while Federal government spending, business equipment, and residential building decreased.

Consumer Economic Data Released in May 2019

Retail Sales data remains weak in 2019 as Consumers continue to pinch their pennies. Consumers cut back on buying cars, electronics, and apparel. Gasoline Sales was up, but that was due to higher gas prices. This is not good news for retailers who are already hurting from online competition. So far this year over 7,000 store closures have been announced, and that's after 5,500 store closures in 2018. Speaking of online sales - they were down too. With such a strong Labor Market and Unemployment at a 50 year low - you would expect Consumers to be spending more on goods and homes.

Retail Sales fell 0.2% in April, up 3.1% in the last 12 months.

Consumer Confidence Index rose to 134.1 from 129.2 the prior month.

Consumer Sentiment Index (U of M) rose to 100.0 from 97.2 the prior month.

Energy, International, and things you may have missed

Oil Prices fell over 10% in May due to fear of a global Economic slowdown (Prices as of June 3: North Sea Brent Crude about $61 per barrel, West Texas Intermediate Crude about $53 per barrel).

An African Swine Fever (Pig Ebola) epidemic is sweeping through China and threatening its pork production, which means they may have to import more pork from the US.

European Elections concluded with Extremists winning over Centrists in many countries.

UK Prime Minister Theresa May will resign June 7th over her frustration brokering a Brexit plan.

Tension between the US and Iran escalated as the US tightened Economic sanctions.

The Venezuelan Central Bank published some dire statistics for their Economy - it has a 929,790% Inflation Rate (not a typo), and their GDP dropped 20% between Jan 1, 2017 and Sep 30, 2018.

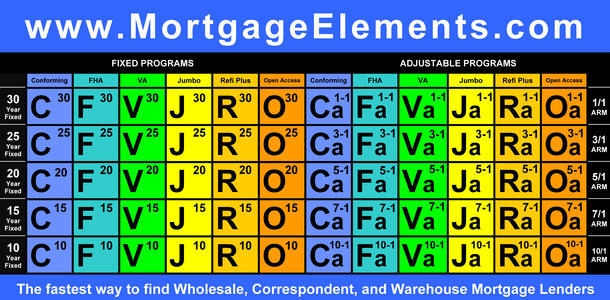

This Economic Commentary is written to be a succinct summary of the key Economic Indicators and Economic Data that influence the Mortgage and Real Estate Industries. It is written for Mortgage Professionals that need to stay current on Economic Information but don't have hours to research and analyze Economic Data. Feel free to share this with a friend or colleague in the Mortgage or Real Estate business. Visit MortgageElements.com where you can explore over 300 Wholesale, Correspondent, and Warehouse Mortgage Lenders from one website.

Mark Paoletti, President and Founder of MortgageElements.com, may be reached by e-mail at [email protected].

This newsletter is for informational and educational purposes only and should not be construed as investment, legal, financial, or mortgage advice. The information is gathered from sources believed to be credible, some is opinion based and editorial in nature. Mortgage Elements Inc. does not guarantee or warrant its accuracy or completeness, and there is no guarantee it is without errors. This newsletter is created for use by Mortgage and Real Estate Professionals and is not an advertisement to extend credit or solicit mortgage originations.

About the author