Advertisement

The Communications Corner: A powerful mortgage marketing Web 2.0 strategy: Tweet Grid

How powerful would it be if, as a mortgage professional, you could tell when someone looking to refinance their home was unsatisfied with their current mortgage professional? Or, if another person is questioning something about the rate they got from the broker they are currently with? Or, what if you could tell when someone was interested in buying a home in your city? This type of information is invaluable to any mortgage professional. These are extremely hot leads to pursue … people who need your help right away! Well these same people are putting this information right out there on the Internet for anyone to see; you just have to know where to look.

I will be the first to admit; at first, I thought Twitter was stupid. In fact, I am still not 100 percent sold on it. I have found ways to make it work for me for my business, but why hundreds of thousands of regular people use it every day to announce to the world what they are doing at that moment in time really does not make sense to me. That being said, if people want to tell the world they need the service I provide and I know how to find them telling the world that, then that is a positive thing for my business. So without much further adieu; I introduce to you the Tweet Grid.

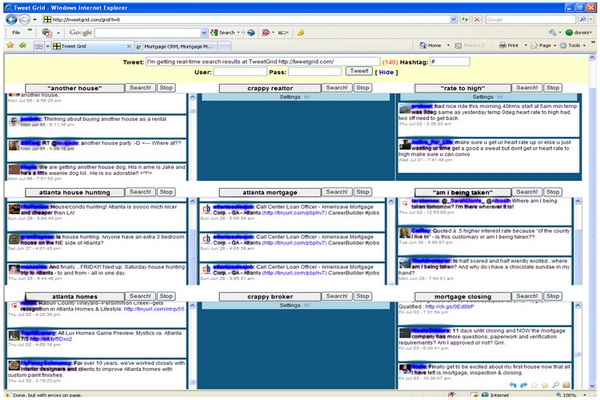

There are multiple social search engines designed to search your various social networking sites that can, in some form or another, yield similar results as Tweet Grid. However, Tweet Grid does not function like a normal search engine, other than the fact that you don’t need to set up any kind of an account to use it and it is completely free. It is (as the name suggests) a grid where you can type in multiple search phrases and the results are fed in to the grid in real-time. In other words, you don’t search for one thing, see your results, and then search for another thing (refreshing the page), see your results, and so on. With Tweet Grid, you can have up to nine searches taking place simultaneously and in real-time. So as someone “Tweets” (I really hate saying that word, and hate typing it even more) the question “Am I being taken by my broker?,” you can be one of the very first people to see it. Take a look at the included grid image. I have blurred out the screen names of the “Twits” (users of Twitter?) to protect the innocent; but you can see what they are typing that match my search criteria.

As you can see; at the time I was writing this blog post, there was:

1. Someone thinking about buying another house as a rental … maybe they need financing.

2. Three people house hunting in my home town of Atlanta … maybe they need financing as well.

3. About 11 days before their scheduled closing, someone is getting some bad vibes from their mortgage company … maybe they could use a second opinion, you may not win the business this time since it is so close to closing, but you could use this opportunity to earn their trust, then maybe add them to your marketing campaign and be there to earn their business next time.

4. Someone who thinks they are being taken by their broker because they were quoted a 0.5 higher interest rate because of the county they live in … come in with an honest quote and educate this prospect and I bet the business is yours.

And all of these examples are just from right now as I type this blog. I may not be a big fan of the concept of Twitter, but as a business owner, I know that if people want to talk about needing my services then I certainly need to listen.

David Orsini is vice president of Top of Mind Networks and oversees the CRM division of the company. David specializes in building systems that help mortgage professionals maximize their relationships with their client base without having to lift a finger. He may be reached at (404) 943-9910.

About the author