Advertisement

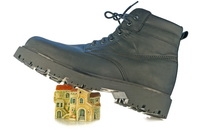

Fannie Mae Announces Special Forbearance Program for Military Homeowners

Fannie Mae and the U.S. Army have announced new initiatives to help service members who are struggling with their mortgage payments avoid foreclosure. The effort includes a mortgage payment forbearance of up to six months where the death or injury of a service member on active duty causes a hardship for impacted military families with a mortgage obligation. The company also announced the creation of a special hotline, (877) MIL-4566, available to all service members to receive guidance about their mortgage options and enlist assistance.

"The men and women of our Armed Forces have shown extraordinary commitment to our country while facing unique challenges as a result of their service," said Jeff Hayward, senior vice pPresident of Fannie Mae's National Servicing Organization. "No family impacted by a death or injury in the line of duty should have to face the additional burden of foreclosure as a result of the hardship. We want to do all that we can to provide support to these families at a time of need as we honor their sacrifices and service to our country."

The Honorable Katherine Hammack, Assistant Secretary of the Army (Installations and Environment), said, "We who serve alongside our military recognize the great sacrifice they and their families make each day. The initiative between Fannie Mae and the lending community recognizes their sacrifice and demonstrates our gratitude for those who face economic hardships as a result of their service. We are profoundly grateful for this heartwarming response from the lending community as they become partners in designing and implementing this initiative."

Service members or surviving spouses who may be eligible for the special forbearance are to contact their mortgage company. The mortgage company may grant forbearance of up to six months under Fannie Mae's "Unique Hardships" guidelines with Fannie Mae's approval. Under forbearance, the mortgage company may reduce or suspend the borrower's monthly payments for the specified period. Credit bureau reporting will be suspended during the forbearance to minimize any derogatory impact.

Fannie Mae has also created printed materials that will be available on military bases to help service members understand their options if they find themselves having trouble making their mortgage payments. Fannie Mae's new consumer education Web site, KnowYourOptions.com, is another resource for struggling homeowners. The site outlines the choices available to homeowners and provides guidance on how they can contact and work with their mortgage company to find solutions.

Service members are encouraged to visit www.KnowYourOptions.com/Military or call the Fannie Mae Military Support Hotline, (877) MIL-4566.

For more information, visit www.fanniemae.com.

About the author