Advertisement

Most Economists Say GSEs Should be Consolidated and Change is Needed in Mortgage Interest Deduction

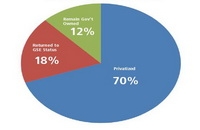

The National Association for Business Economics (NABE) has released its March 2011 Economic Policy Survey which surveyed its members on a number of policy issues. Respondents to the survey expressed concern about rising fiscal budget deficits and are eager for the president and Congress to curb federal spending. A key finding of the study was that more than 70 percent believe that Fannie Mae and Freddie Mac should be consolidated due to their similar purpose. Seven out of 10 of the survey panelists believe that Fannie Mae and Freddie Mac should ultimately be privatized. Eighteen percent believe that these entities should return to their prior status as government-sponsored enterprises (GSEs), while 12 percent think they should remain under government ownership.

Most panelists surveyed believe that he GSEs should be gradually wound down, with 63 percent envisioning a two- to three- year downsizing process, and another 17 percent feeling the GSEs should be reduced over a six- to 10-year span. Under the Dodd-Frank Act, banks originating mortgage loans will be required to retain five percent of the risk

unless those loans are Qualified Residential Mortgages (QRMs). Slightly more than one-half (51 percent) of NABE respondents believe that a mortgage should have a loan-to-value (LTV) ratio of no more than 80 percent to qualify as a QRM, while another 20 percent think that the LTV ratio should be 70 percent or less.

Respondents to the NABE survey also found that less than 50 percent were in favor of retaining the full deductions for mortgage interest, state and local taxes, and charitable contributions, but in no case did a majority or even a plurality favor outright elimination. For each of these deductions, the median answer was to limit, but not eliminate, the deduction. The least support for retaining full deduction was for mortgage interest (24.4 percent) and highest for charitable contributions (47 percent), with state and local taxes in between at 39.6 percent.

For more information, visit www.nabe.com.

About the author