Advertisement

Pieces of the P.I.e: Paper, imaged and e-Documents

It’s no question that the mortgage industry is in a state of transition. To overcome the obstacles and survive market turmoil, lenders must face the realities of the market and evolve their processes to become as efficient and cost-effective as possible. In recent years, an increasing number of mortgage companies have committed to going “paperless.”

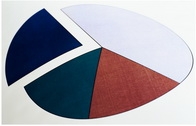

Companies are moving toward paperless offices at different speeds and are often working with a combination of paper, imaged and electronic documents—or “P.I.e.”

By having a holistic view of the entire mortgage loan process and a better understanding of each component of the P.I.e, organizations can streamline processes and ensure their outsourced partners will meet the demanding needs of the current market environment and make their operations as efficient as possible.

Paper

The mortgage industry has long recognized that mounds of paper fill offices and overflow desks. These paper files are, at times, necessitated by government regulations, such as the Electronic Signatures in Global and National Commerce (E-SIGN) Act. At other times, they are required by lenders who have not yet evolved to paperless processes and rely on hard copy files to get work done. In any case, it is no mystery what makes paper so difficult to manage.

Loans consist of multi-page documents and forms—such as applications, earnings verifications, statements, tax forms, credit reports, appraisals and contracts—that need to be prepared, accepted and processed. As this process occurs, paper piles up—filling cabinet space, requiring additional postage fees and taking a toll on the environment. In the end, traditional paper loan folders can generate an excess of $100 each to maintain for just two years. Even worse, as the loan matures, even more costs can mount with archiving and retention fees.

As lenders continue to become aware of the increased costs associated with paper, they realize the need to reduce the paper portion of the P.I.e. In an effort to do so, organizations are leveraging online collaborative technologies to share loan information.

Imaging

On-demand imaging services and capabilities can be used in a variety of ways to evolve organizations to a “paper-free” office environment. From origination to post-closing, files can be quickly and easily shared online to drive efficiency, increase productivity and reduce costs.

Once paper files are received, organizations can image or scan the files into an electronic loan folder, or they can outsource this step to a third-party vendor that can also extract relevant, necessary data from the files. Once the data is extracted, lenders can manage the imaged files in a more organized fashion further increasing efficiency. In addition, online imaging capabilities enable a collaborative, all-access view of the loan files where other mortgage loan constituents can quickly review and accept documents, thereby improving turnaround.

A recent imaging technology being used by the mortgage industry is the DataGlyph, which is very similar to a barcode tag. By using a sophisticated tag, placed on the first page of the paper stack that is scanned into an electronic loan folder, files can be indexed quickly and automatically. For example, Wisconsin Mortgage Corporation is using this new technology as a way to reduce labor and paper costs. The tags can store important data and offer redundancy when damaged or tampered. They also ensure the document is stored in the proper location within the electronic folders so Wisconsin Mortgage can upload documents without the use of a scan cover sheet.

Electronic documents

As the final piece of the P.I.e, a true electronic mortgage (or e-mortgage) would require that the loan files are never signed on paper. From the outset of the loan process, with the initial application, to the final step of sending the loan folder for archiving, files are living documents within the electronic loan folder. With a true e-mortgage solution, files within a loan document can be tagged with meta data, which enables system comparisons and greatly reduces costly processes of comparing image docs to data systems.

E-mortgages more securely complete loan transactions, thereby protecting consumers’ personal financial information, in accordance to federal regulations. With today’s collaborative loan processing technologies, security measures have been put in place to guarantee financial data remains confidential and safe. For example, some e-mortgage technology providers offer a secure, personal electronic signing room for loan documents to be signed. Rather than a typical disclosure or closing process where borrowers sign a significant amount of paperwork to finalize the loan, an electronic signing room enables them to view the files electronically in the closing room and sign with an electronic signature.

By providing each individual party with unique authentication credentials, these e-mortgage technologies can lock down documents and track changes while ensuring only designated parties are able to view and sign the documents.

Get your piece of the P.I.e

According to a recent survey of mortgage lenders conducted by Xerox Mortgage Services, 31 percent of survey participants believe it will take less than five years for the mortgage industry to process more than 50 percent of all loans as an e-mortgage. Another 44 percent believe it will take five to seven years. These survey results confirm that the market is striving for a paperless solution to improve efficiencies and reduce costs.

Until the mortgage industry is ready to go completely paper free, which, due to regulations, may not be for some time, “paper light” loan processing can be achieved by using various components of the P.I.e. Imaging and scanning technology that transforms hard copy files into electronic documents allows documents to be instantly circulated to necessary parties to streamline processes and turn loans faster.

Guild Mortgage Company, headquartered in San Diego, Calif., is one organization that has already taken the e-mortgage leap, beginning the process of a secure, convenient way to deliver, sign, store, access and manage the lifecycle of its loan documents. The solution is targeted at helping Guild decrease costs associated with storing, printing and mailing hard copy loan documents and has increased pull-through rates. The e-mortgage process also allows Guild to comply with the Real Estate Settlement Producers Act (RESPA) that mandates the tracking and management of disclosure documents within 72 hours.

Make your checklist

Lenders already working with the P.I.e, or those considering advancing their organization through new technology purchases, need to consider their technology roadmap when selecting a vendor. Companies can easily create a checklist of requirements that should include support for future paperless strategies, such as e-mortgages, e-signature and e-vaults. Solutions must be flexible to incorporate other pieces of the P.I.e, such as imaging and DataGlyphs. With these requirements in hand, an organization can be prepared to make a long-term decision on its vendor partners.

By understanding the components of the P.I.e, an organization can focus on its next steps for going paperless—without being overwhelmed with the need to move straight from traditional loan processing to pure electronic loan processing. As they say, “the pie is ready.”

Greg Smith is vice president and general manager for Xerox Mortgage Services, formerly Advectis Inc., provider of BlitzDocs, a widely-used solution for electronic mortgage document collaboration.

About the author