HUD Housing Survey Finds Neighborly Help Alive and Well

Roughly half of all American households report getting along with their next door neighbors and are willing to lend a helping hand if needed. That’s among the findings of the 2013 American Housing Survey being released by the U.S. Department of Housing & Urban Development (HUD) and the U.S. Census Bureau. This report marks the 40th year the American Housing Survey (AHS) has been taking a deep look at the U.S. housing stock including detailed information on housing costs and quality. The 2013 AHS, includes new information about neighborhood social life, use of public transportation, and the extent to which American families are prepared for disaster. The 2013 survey includes the following findings:

Neighborhood Social Life

►82.4% of households report talking to their neighbor with the past month.

►50.7% strongly agree they get along with their neighbors.

►49.7% are very willing to help their neighbors.

Public Transportation/Biking/Walking

►17.4% or 20 million households use some form of public transportation, primarily local buses (approximately 14 million households).

►40.2% of households report biking or walking to nearby destinations such as entertainment, grocery stores, shopping centers, work, school and places of worship.

►55.8% or 64.6 million households report sidewalks in their neighborhood.

►14.5% of households report their neighborhoods have dedicated bike lanes.

Disaster Preparedness

►83.7% of households claim to have enough non-perishable food to sustain family members for three days.

►38% of 2-or-more-person households have an agreed-upon meeting location in the event of an emergency.

►56.7 million households have a pet including 15.2 million pet-owning households that need help evacuating their pets in the event of an emergency.

►27.7% of households do not have sufficient funds ($2000) in the event of an emergency evacuation.

Characteristics of U.S. Homes

►There were nearly 133 million total housing units in the U.S. in 2013, 87% of which were occupied. This represents an increase of 413,000 since 2011.

►65% of all housing units were occupied by owners in 2011; 35% were occupied by renters.

►As of 2013, the median size of all single-family detached housing units was 1,800 square feet with a median lot size of .25 acres (compared to .36 acres in 1973).

►Approximately two-thirds of all housing units used warm-air furnaces for heating; 12.1% used an electric heat pump; and 10.4% used steam/radiant heating.

►The most common cooking fuel is electricity (61.2%) followed by natural gas/propane (38.7%).

►Between 2011 and 2013, there was a slight decline in the number of homes experiencing moderate or severe physical problems (including plumbing, heating, and electrical). In 2013, there were nearly 2 million homes with severe physical problems and nearly 4 million housing units with moderate physical problems.

►10.3% of all households reported seeing signs of cockroaches within the prior 12 months.

►9.1% of households reported evidence of mice in the last 12 months.

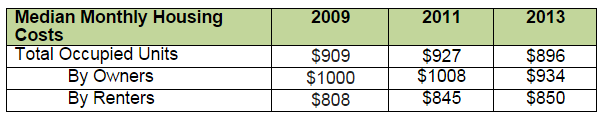

Housing Costs

Median monthly costs went down for all occupied housing units between 2011 and 2013. However, this masks the fact that while owner-occupants’ costs fell, the costs paid by renters increased.